What’s the Difference Between Medicare Advantage and Medicare Supplement Plans?

Are you a beneficiary of Original Medicare Parts A & B? These initiatives cover many medical and hospital expenses but don’t cover everything.

If you want further assistance reducing your out-of-pocket healthcare expenses, you must turn to an additional policy.

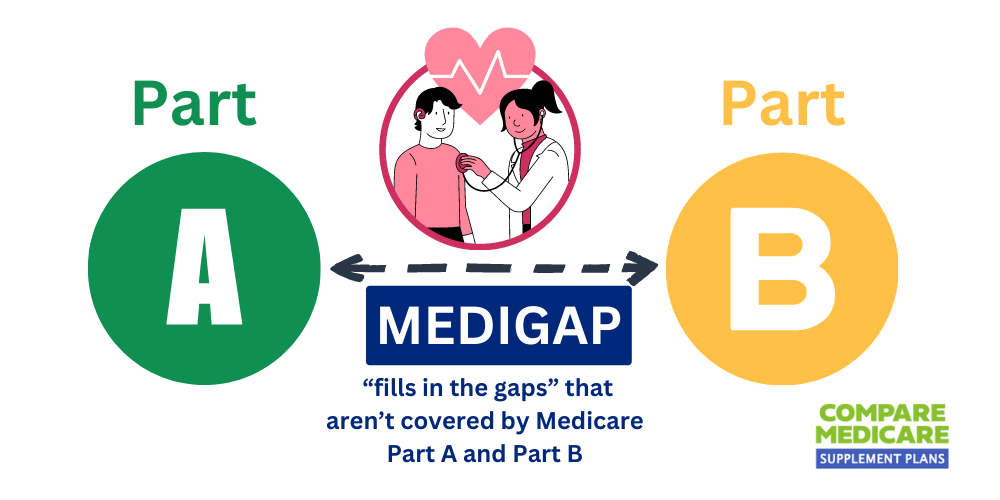

Medicare Advantage and Medicare Supplement Plans (Medigap) are two policies helping you cope with the healthcare expenses not covered by Original Medicare.

This post examines the difference between Medicare Advantage and Medicare Supplement Plans.

Difference Between Medicare Advantage and Medicare Supplement – Key Takeaways

Medicare Advantage

- Many plans have a $0 deductible, no copays for primary physicians, and low copays for specialist practitioners.

- MA plans give you restricted access to hospitals and providers.

- You must be enrolled in Original Medicare Parts A & B to qualify for MA plans.

- Most plans come with Part D coverage for prescription medications.

- Some plans include additional benefits for gym memberships, hearing, vision, and dental services.

- Some policies offer out-of-network coverage with medical practitioners and providers.

Medicare Supplement Plans

- Predictable monthly premium costs and predictable annual healthcare expenses.

- Some policy providers may offer additional vision, dental, and hearing benefits.

- Plans don’t cover prescription drugs.

- 80% coverage for medical costs during international travel.

- You must be enrolled in Original Medicare Parts A & B to qualify.

Speak to Us About the Difference Between Medicare Advantage and Medicare Supplement Plans

Call us at 1-888-891-0229. We offer a free consultation and quote on Medicare Advantage and Medigap plans.

Our fully licensed agents can assist you with finding the right policy to match your healthcare requirements and budget.

Or you can leave your details on our contact form, and we’ll have an expert call you back.

Compare Plans & Rates

Enter Zip Code

What Is Medicare Advantage?

Also known as “Part C,” Medicare Advantage plans essentially replace your Original Medicare Parts A & B policies.

They cover all medical and hospitalization benefits, and some even offer coverage for preventative services like:

- vision,

- dental,

- and hearing.

Many MA plans also cover the cost of your prescription medications. However, your choice of doctors and hospitals is limited with Medicare Advantage, and you must use these in-network providers for your healthcare requirements.

There are approximately 30 Medicare Advantage Plans; here are some examples:

- Health Maintenance Organizations (HMOs).

- Preferred Provider Organizations (PPOs).

- Private Fee-for-Service (PFFS) plans.

- Special Needs Plans (SNPs).

*Not all MA plans are available in all states.

Medicare Advantage – Benefits

MA plans provide all the same benefits as Original Medicare Parts A & B, but some also include the preventative service discussed earlier.

Some plans offer transportation to doctors’ rooms and options for adult daycare services.

How Much are Medicare Advantage Premiums?

Several MA plans have zero monthly premiums. However, you’ll have to meet the Part B deductible of $226 for 2023.

After paying the deductible, you’ll make a 20% copayment of Medicare-approved services and products, such as glucometers, hospital beds, walkers, and more.

What Is Medigap?

Medigap policies are available in all 50 states from healthcare insurers.

There are ten different plans, each offering varying levels of coverage to settle the 20% of medical and hospital expenses not paid by Original Medicare Parts A & B.

Medicare Supplement Plans – Benefits

Medigap plans provide standardized benefits covering the out-of-pocket costs involved with Original Medicare Parts A & B.

They provide consistency and predictability to your annual healthcare expenses.

The Federal government regulates the Medigap industry, ensuring all providers offer beneficiaries the same benefits.

That means the Plan N policy you get from Aetna in New York will be the same as the Plan N policy you get from BCBS in Los Angeles.

All plans offer the following basic benefits for out-of-pocket expenses involved with Original Medicare Parts A & B.

- Part A Hospital coinsurance coverage.

- Part A deductible (some plans, like Plan M, only offer partial coverage).

- 365 additional days of full hospital coverage after your Medicare benefits run out.

- Partial or full coverage for the 20% coinsurance for Part B services.

- Full coverage for the first three pints of blood in medical procedures and transfusions.

- Hospice coinsurance for respite care and pain relief medications (copayments apply).

Some more comprehensive Medigap plans, like F & G, offer additional coverage for the following.

- Part B Deductible (Plan F only).

- Skilled nursing facility coinsurance or copayments.

- 80% of the costs involving emergency care outside the US (deductibles and limits apply).

Medigap policies don’t cover costs involved with private nursing care, long-term care at nursing homes, and prescription medications.

They also don’t cover the costs of your preventative care involved with hearing, dental, and vision services.

However, some insurers offer additional top-up plans that cover these costs for a fee ranging from $18 to $42, depending on your area and health status. For instance, the “Plan G Plus” policy from Blue Cross Blue Shield covers these costs.

Since private insurers compete for your business and provide additional benefits and perks, such as meal delivery and discounted gym memberships.

Many also offer discounts on premiums if you pay your annual premiums upfront or set up automatic payments on your credit card or bank account.

You can use a licensed agent like us to advise you on the best discounts and perks offered by Medigap providers in your state.

Medicare Supplement Insurance – Premiums

While Medicare Advantage plans have many free options, Medigap policies all come with a monthly premium on top of your financial responsibility for your Original Medicare Parts A & B policies.

While Medicare Advantage plans have many free options, Medigap policies all come with a monthly premium on top of your financial responsibility for your Original Medicare Parts A & B policies.

However, unlike MA, Medigap gives you access to any medical practitioner or hospital in the Medicare network across the United States.

You also don’t have any out-of-pocket limitations on your cover (Except for plans K & L), and you get coverage for medical emergencies when traveling outside the United States.

Typically, you can expect to pay anywhere from $40 to $400 for a Medigap policy, depending on the coverage it provides, your personal risk profile, and your state.

Since private insurers offer Medigap, they can charge whatever they want for the policies. As a result, plan premiums can differ from insurer to insurer and state to state.

Women and nonsmokers get better rates than men and smokers, and some states are more expensive for the policies they provide than others.

Frequently Asked Questions

What’s the main difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage replaces Original Medicare with private insurance, while Medicare Supplement fills gaps in Original Medicare coverage.

Which offers more comprehensive coverage, Medicare Advantage or Medicare Supplement?

Medicare Supplement plans generally provide more comprehensive coverage than Medicare Advantage.

Do Medicare Advantage and Medicare Supplement cover prescription drugs?

Medicare Advantage often includes prescription drug coverage, while Medicare Supplement does not. A standalone Part D plan may be needed with Medicare Supplement.

Are there network restrictions with Medicare Advantage and Medicare Supplement?

Medicare Advantage plans have network restrictions, while Medicare Supplement plans do not.

Which is more cost-effective, Medicare Advantage or Medicare Supplement?

Cost-effectiveness varies, with Medicare Advantage having lower premiums but potential copayments, and Medicare Supplement having higher premiums but predictable costs.

Can I switch from Medicare Advantage to Medicare Supplement, or vice versa?

Switching is possible but subject to enrollment periods and eligibility criteria.

Do Medicare Advantage and Medicare Supplement cover vision and dental care?

Some Medicare Advantage plans offer limited coverage, while Medicare Supplement does not. Separate plans may be needed.

Do Medicare Advantage and Medicare Supplement cover emergency care?

Both provide coverage for emergency care, meeting at least the level of Original Medicare.

Can I have both Medicare Advantage and Medicare Supplement plans simultaneously?

No, you must choose one or the other; they cannot be used together.

How do I decide between Medicare Advantage and Medicare Supplement?

Consider individual healthcare needs, preferences, and budget. Compare plans, consult providers, and seek guidance for an informed decision.

Difference Between Medicare Advantage and Medicare Supplement Plans - How to Start

Before you decide between Medicare Advantage and Medicare Supplement Plans, it’s also important to compare quotes from several insurance companies.

To start comparing estimates from the most credible health insurers, submit the form to the right of the screen or call 1-888-891-0229 now!

Updated December 4th, 2022