Medicare Supplement Plan List – Plans & Benefits

Medicare supplemental insurance, otherwise known as Medigap, is a backup policy to your Original Medicare policies, Parts A & B, giving you additional coverage for your out-of-pocket expenses involved with your hospitalization and medical costs, such as seeing the doctor.

Original Medicare doesn’t pay for everything and only covers approximately 80% of costs.

Your Medigap policy covers you for the other 20%.

With Medigap, you don’t have any other additional expenses to pay, giving you total peace of mind that you don’t have anything else to pay.

With Medigap, you get everything you need to relieve your responsibilities for out-of-pocket expenses.

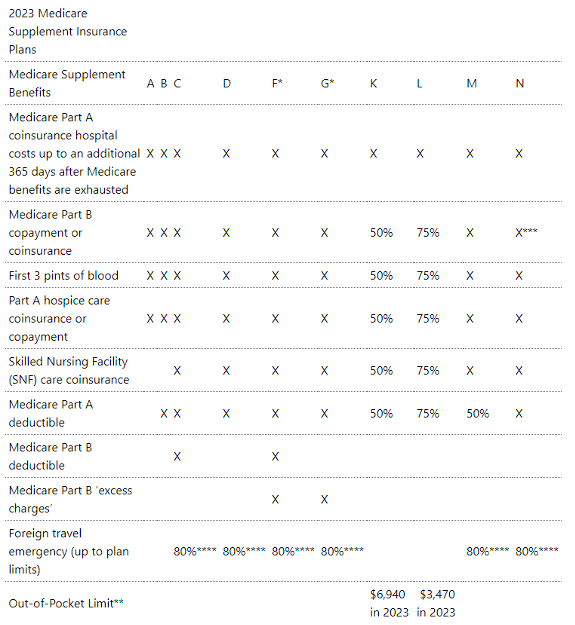

Medigap policies are available in ten variations; each plan has a letter, A, B, C, D, F, G, K, L, M & N, giving you a wide choice of options.

Each plan offers a different level of coverage, and some are more comprehensive than others.

This post walks you through the plans and benefits of Medical Supplemental insurance.

Get a Free Consultation on Any Medigap Plan

If you need assistance choosing a Medigap policy, call our fully licensed agents for a free consultation and quote.

We’re available to you at 1-888-891-0229 to discuss your healthcare needs.

Or you can leave your details on our contact form, and we’ll have someone get back to you.

Our online quoting tool can give you an automated, free quote on any Medigap plan.

Enter your preferred plan and zip code, and you’ll have a quote for the best rates in your state in seconds.

Medicare Supplement Plan List – Medigap Plans & Benefits

The Federal government regulates the Medigap industry, ensuring all providers offer the same benefits and coverage in their Medigap plans.

Each plan has a varying level of coverage, with some being more comprehensive than others.

Here’s a brief overview of what you get from each Medigap plan.

- Medigap Plan A — Offered by all Medigap providers. You get basic coverage for Original Medicare. This plan covers the basic benefits of Parts A & B.

- Medigap Plan B — Basic Benefits and coverage for your Part A deductible.

- Medigap Plan D — Mid-tier pricing and coverage for most benefits in Parts A & B.

- Medigap Plan F – The most popular plan with seniors before the cut-off date of January 1, 2020. You get coverage for all out-of-pocket expenses involved with Original Medicare Parts A & B.

- Medigap Plan G — The most popular plan in the range for new Medicare enrollees. You get near comprehensive coverage, but you’ll have to pay the $226 Part B deductible.

- Medigap Plan K — A popular choice for low-income seniors. You get 50% coverage for many Part B benefits.

- Medigap Plan L — Similar benefits to Plan K, but it offers 75% coverage.

- Medigap Plan M — Good coverage for many benefits, but it only pays half of the Part A deductible.

- Medigap Plan N — The best choice for healthy seniors that want good coverage in medical emergencies but lower monthly premiums. You’ll also have copayment responsibilities with this plan.

*Plans C & F are no longer available for new enrollees to Medigap unless you’re eligible for Medicare before January 1, 2020.

This chart gives you an idea of the coverage in each plan.

Contact our team if you need assistance choosing the right policy for your needs.

What Isn’t Covered by Medigap Plans?

Medigap plans don’t cover everything to do with your healthcare expenses; they only take care of the out-of-pocket expenses involved with Original Medicare Parts A & B.

Medigap plans don’t cover everything to do with your healthcare expenses; they only take care of the out-of-pocket expenses involved with Original Medicare Parts A & B.

That means you don’t have coverage for prescription medications, and there’s no coverage for preventative care and treatments, such as acupuncture and physiotherapy.

Standard Medigap benefits don’t cover your hearing, vision, and dental services, but some providers add these services as perks in their plans, some time for free and other times for an additional cost.

Medigap plans vary in coverage for inpatient and outpatient services, so speak to our agents about the right plan for your peace of mind and budget.

For instance, plan N, one of the most popular options, offers low monthly premiums.

However, you’ll have to make copayments at the doctor’s office of $20 and a $50 copayment on a trip to the emergency room, which is waived if you’re admitted to the hospital.

Plan N also doesn’t cover you for excess charges.

Excess charges are the amount not covered by Medicare Part B when visiting a doctor charging above the Medicare-approved rate.

You can mitigate these costs by seeing doctors in the Medicare network charging “Medicare Assignment” for consultations.

What Do Medigap Plans Cost? – Understanding How Medigap Premiums Work

Medigap policies vary in the coverage they offer and the monthly premiums cost.

Plans F & G are the most expensive options, but they offer the most comprehensive level of coverage.

Plans F & G are the most expensive options, but they offer the most comprehensive level of coverage.

However, Medigap Plans F & G are only available to seniors eligible for Medicare before January 1, 2020.

If you qualify for Medicare after this date, you’ll need to sign up for Plan G.

Plan G has lower premiums than Plan F, but you’ll have to pay the Part B deductible of $226, which Plan F covers.

The savings you make on premiums with Plan G usually account for the Part B deductible fee, making it a good choice for the most comprehensive Medigap coverage.

Some providers offer a high-deductible version of Plans F & G, but they aren’t available in all states or from all providers.

The HD version increases your Part A deductible to $2,700 from $1,600 annually.

However, you see a massive drop in monthly premiums. It is a good choice for seniors that want full coverage in the event of a medical emergency but lower monthly healthcare costs.

Insurers assess your age, gender, smoking status, and location when setting your premiums.

These factors create your risk profile for the company and determine your policy’s final costs.

Men and smokers pay more for Medigap policies than nonsmokers and women.

Some insurers increase your policy premiums as you age, while others lock you into a specific price that only increases with economic factors like inflation.

Your location in the US is the biggest factor in determining your premiums.

For instance, the cost of Medigap policies might be higher in one state and lower in another for the same plan.

Speak to our team, and we’ll get you the best rate on Medigap premiums in your state.

Alternatively, you can use our automated quoting tool on our site to get a free quote for a Medigap plan in your state.

Frequently Asked Questions

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also known as Medigap, is a private health insurance plan that helps cover the gaps in Original Medicare, such as deductibles, copayments, and coinsurance.

How do Medicare Supplement Plans work?

Medicare Supplement Plans work alongside Original Medicare. They pay for some or all of the out-of-pocket costs that Medicare doesn’t cover, depending on the plan you choose.

What are the different types of Medicare Supplement Plans?

There are ten standardized Medicare Supplement Plans available, labeled with letters (A, B, C, D, F, G, K, L, M, and N).

How do I choose the right Medicare Supplement Plan for me?

Choosing the right Medicare Supplement Plan depends on your individual needs and budget. Factors to consider include your healthcare needs, anticipated costs, and the available plans in your area.

Are Medicare Supplement Plans the same as Medicare Advantage Plans?

No, Medicare Supplement Plans and Medicare Advantage Plans are different.

Can I enroll in a Medicare Supplement Plan anytime?

No, there are specific enrollment periods for Medicare Supplement Plans. The best time to enroll is during your Medigap Open Enrollment Period, which starts when you’re 65 or older and enrolled in Medicare Part B.

How much do Medicare Supplement Plans cost?

The cost of Medicare Supplement Plans varies depending on the plan you choose, your location, and the insurance company. Premiums are typically paid monthly in addition to your Medicare Part B premium.

Are pre-existing conditions covered by Medicare Supplement Plans?

Medicare Supplement Plans generally cover pre-existing conditions, but it’s important to enroll during your Medigap Open Enrollment Period. Outside of that period, insurance companies may impose medical underwriting, which could result in higher premiums or denial of coverage.

Can I change Medicare Supplement Plans?

Yes, you can switch Medicare Supplement Plans at any time, but it’s important to consider certain factors. Switching plans may require medical underwriting, and you may lose certain benefits or face higher premiums.

Do Medicare Supplement Plans cover prescription drugs?

No, Medicare Supplement Plans do not cover prescription drugs. To get prescription drug coverage, you need to enroll in a Medicare Part D plan, which is a separate insurance plan specifically for medications.

Explore the Medicare Supplement Plan List

Are you nearing the age of 65 and searching for the perfect healthcare option that suits your needs?

Before you make a final decision, it’s important to assess the estimated costs associated with your desired plan.

To obtain quotes from reputable insurance providers, you can conveniently fill out the form on the right-hand side.

Alternatively, you may call 1-888-891-0229 to connect with an experienced agent who can provide you with the necessary information.

Updated December 4th, 2022