How Much is Medicare Supplemental Insurance?

For millions of Americans, Medicare is a real lifesaver. The government-sponsored health insurance plan provides insurance coverage for individuals who are aged 65 and older, as well as younger individuals who have been diagnosed with certain illnesses or diseases.

While Original Medicare, which includes Part A and Part B, covers a lot of the medical expenses, it doesn’t cover everything.

For things like deductibles, copays, and coinsurance, as well as care and services that aren’t covered by Medicare, beneficiaries are required to pay for these expenses themselves.

The out-of-pocket expenses for Original Medicare can become expensive; not to mention, they can be unpredictable. That’s where Medicare Supplement Insurance (Medigap) can help.

If you’re thinking about purchasing Medigap insurance, there are a lot of factors that you’re going to want to take into consideration so that you can make the best choice for your individual needs. Cost is one of those factors.

To learn about the cost of Medicare Supplemental insurance for 2024, including how policies are priced, as well as additional information that will help steer you in the right direction, please continue reading.

An Introduction to Medicare Supplemental Insurance

Original Medicare features two individual parts, and these parts cover different medical expenses.

Medicare Part A covers the cost of inpatient care and services, such as hospital stays, while Medicare Part B covers the expenses that are related to outpatient care and services, like doctor visits and durable medical equipment.

As mentioned, Original Medicare doesn’t cover everything, and that’s where Medicare Supplemental Insurance can help.

Medicare Supplemental Insurance, also known as Medigap, is supplemental insurance that covers some of the out-of-pocket expenses that Part A and Part B don’t cover.

There are 10 different Medigap plans, which are regulated by the federal government, and are sold by private insurers.

The 10 plans are named for letters and each lettered plan must offer the same standard benefits, as required by the US government, no matter what part of the country the policy is purchased or what insurers provide it.

For instance, all Medigap Plan N policies must offer the same benefits, whether the policy is purchased in Nebraska or New Mexico, and regardless of the insurance company that provides it.

Private insurance companies can, however, offer additional perks, on top of the standard benefits that the policies they sell provide.

Medigap is an additional insurance policy. It doesn’t replace Original Medicare, but rather it fills in for some of the costs that Original Medicare doesn’t cover.

Because Medigap and Medicare are two separate forms of insurance, you will need to pay a monthly premium for both.

How Much Does Medicare Supplemental Insurance Cost?

The insurance companies that sell Medicare Supplemental Insurance policies determine the rates that they charge, which means that prices vary.

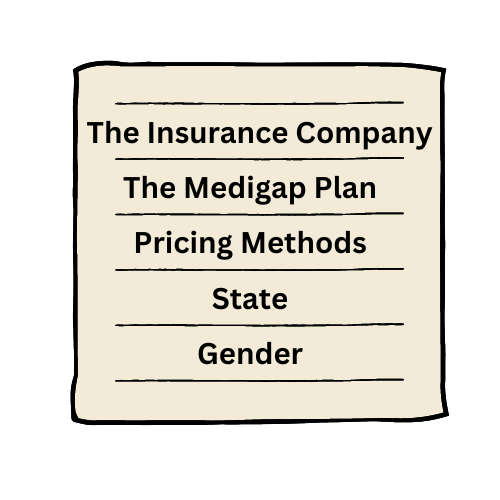

There are several factors that affect the cost of Medicare Supplemental Insurance.

These factors can include the following:

1. The Insurance Company

1. The Insurance Company

The private insurance company you purchase Medicare Supplemental Insurance from is one of the biggest factors that will impact the cost of your coverage.

Some providers charge higher rates than others for the same policies; for example, Mutual of Omaha tends to charge higher rates for the policies they provide, while Aetna charges some of the lowest rates in the nation.

The insurance company you purchase the policy from does make a difference, however; for example, though Mutual of Omaha does charge higher rates, they have an excellent track record and one of the lowest customer complaint ratings in the Medigap industry.

Conversely, Aetna may charge lower rates, but the amount of member complaints is much higher than the market average.

2. The Medigap Plan

Another key factor that has a significant impact on the cost of Medicare Supplemental Insurance is the policy you purchase.

Remember, there are 10 different Medigap policies, and each policy provides different coverage. Policies that offer more comprehensive insurance – that cover more Original Medicare out-of-pocket expenses – will cost more than Medigap plans that cover fewer out-of-pocket expenses.

To illustrate, Medigap Plan G provides the most coverage for new Medicare enrollees, but the price for this coverage is higher than Plan A, which only offers the basic benefits that are required by the government.

3. Pricing Methods

It doesn’t matter which private insurance company you purchase your Medigap insurance from, you can expect the cost of your premiums to increase on a yearly basis.

Insurance companies use one of the following methods to determine how much they will charge for premiums on the policies they offer:

- Issue-age. This is one of the most commonly used pricing methods. Companies that use this method base the premiums they charge on an applicant’s age when they apply and the price won’t increase as they age. In fact, the younger you are, the lower the price will be.

- Attained-age. With this pricing method, your age determines the cost of your premiums. While prices may be lower at first, as you age, they will increase.

- Community-rated. With this pricing method, the cost of Medigap insurance won’t increase as a result of your age; rather the prices increase as a result of other factors, such as inflation or the cost of healthcare. All policyholders within a community are charged the same rate, no matter their age.

4. State

Another key factor that will affect the cost of your Medicare Supplemental Insurance is your location.

The cost of living is higher in some states, so in these states, the cost of Medigap plans will be higher. For instance, if you purchase a plan in New York, the price will be higher than if you were to purchase the same plan in Idaho.

5. Gender

Your sex can also influence the cost of your Medigap insurance. Women live longer than men on average, and as such, the prices for their Medigap coverage tend to be lower than the same coverage for men.

Frequently Asked Questions

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also known as Medigap, is a private health insurance policy that helps cover the gaps in Original Medicare. It helps pay for healthcare costs such as deductibles, copayments, and coinsurance.

How much does Medicare Supplemental Insurance cost?

The cost of Medicare Supplemental Insurance can vary depending on various factors such as your location, the insurance company, the plan you choose, and your age. On average, premiums can range from $50 to $300 per month.

Are Medicare Supplemental Insurance premiums tax-deductible?

In most cases, Medicare Supplemental Insurance premiums are not tax-deductible. However, it’s advisable to consult with a tax professional to understand the specific tax implications based on your situation.

Can the cost of Medicare Supplemental Insurance increase over time?

Yes, the cost of Medicare Supplemental Insurance can increase over time. Insurance companies may raise premiums due to factors such as inflation, changes in healthcare costs, and age-related increases.

Are all Medicare Supplemental Insurance plans priced the same?

No, Medicare Supplemental Insurance plans are not priced the same. Different insurance companies offer various plans, and each plan has different pricing structures. It’s essential to compare plans and prices to find the one that suits your needs and budget.

Can I change my Medicare Supplemental Insurance plan if the cost increases?

Yes, you can change your Medicare Supplemental Insurance plan if you find a more affordable option. However, keep in mind that switching plans may require medical underwriting, and you may lose certain benefits from your current plan.

Are there any discounts available for Medicare Supplemental Insurance?

Some insurance companies offer discounts on Medicare Supplemental Insurance premiums. These discounts may be available for various reasons, such as non-smoker discounts, household discounts, or discounts for paying premiums annually.

Does Medicare Supplemental Insurance cover prescription drugs?

No, Medicare Supplemental Insurance does not cover prescription drugs. To get coverage for prescription medications, you need to enroll in a separate Medicare Part D plan or a Medicare Advantage plan that includes prescription drug coverage.

Can I enroll in Medicare Supplemental Insurance at any time?

No, there are specific enrollment periods for Medicare Supplemental Insurance. The best time to enroll is during the open enrollment period, which starts on the first day of the month after you turn 65 and are enrolled in Medicare Part B.

Is the cost of Medicare Supplemental Insurance the same for everyone?

No, the cost of Medicare Supplemental Insurance can vary for each individual. Factors such as your age, gender, location, and the insurance company you choose can influence the premium rates. It’s recommended to compare multiple insurance providers to find the best price for your circumstances.

Find Great Rates on Medicare Supplemental Insurance Today!

If you’re planning on purchasing Medigap insurance to fill in the gaps for Original Medicare, compare costs from the top insurance providers in your area today!

Simply fill out the form to the right and you’ll receive instant access to estimates.

You can also give us a call at 1-888-891-0229 and our licensed insurance agents will be happy to help you find the best coverage for your needs.

Updated December 4th, 2022

1. The Insurance Company

1. The Insurance Company