Choosing A Medicare Supplement

Finding the right Medicare supplement insurance can seem overwhelming, but it’s an important decision to make.

Medicare supplement plans are sold by private insurance companies that help cover the expenses not covered by Medicare, such as:

- copayments,

- deductibles,

- and coinsurance.

Popular companies offering Medicare supplement plans are:

And many more.

With so many options available, it can be difficult to determine which plan is right for you. When shopping for Medigap insurance, there are several factors to consider.

You’ll want to look at your healthcare needs and budget to see which plans offer the best coverage for your specific situation.

Additionally, you’ll need to research the different types of plans available and compare their benefits and costs before making your final decision.

Understanding these key considerations will help you select a plan that provides the necessary coverage while also meeting your financial goals.

What Is A Medicare Supplement?

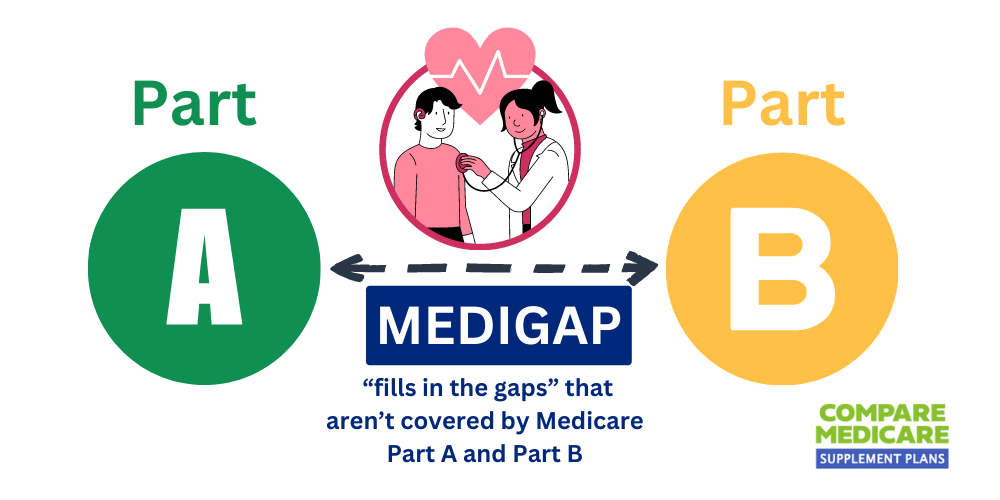

A Medicare supplement, also known as Medigap, is an additional insurance policy that helps cover some of the costs not covered by Medicare Part A and B.

These plans are offered by private insurance companies and can be used to pay for deductibles, copayments, and other out-of-pocket expenses associated with your Medicare benefits.

When looking for the best Medigap plan for you, it’s important to consider factors such as:

- cost,

- coverage options,

- and network providers.

In the next section, we’ll dive deeper into the different types of Medigap plans available and what they offer.

Medicare Supplement Plans

Imagine a world where you can receive medical treatment without worrying about the cost. Sadly, this isn’t always possible with Medicare alone, which is why enrolling in a Medigap plan is a good idea for many people on Medicare.

With so many options available, it’s easy to feel overwhelmed when trying to find the best medicare supplement insurance plan.

Fortunately, there are plenty of resources out there that can help guide you through the process of selecting the best medicare supplement insurance policy for your needs.

The first step is understanding what exactly these plans cover and how they differ from one another.

It’s also important to keep in mind that not all Medigap Plans are created equal – some may offer more comprehensive coverage than others or be tailored toward specific health concerns.

By doing your research and comparing different options, you’ll be able to make an informed decision on which plan will work best for you and your unique healthcare needs.

When considering a Medigap insurance policy, it’s important to remember that while price matters, it shouldn’t be your sole deciding factor. Take into account factors such as:

- deductibles,

- co-pays,

- prescription drug coverage,

- and network restrictions before making any final decisions.

In the next section, we’ll dive deeper into the specifics of medicare supplement insurance policies and what you need to know before signing up for one.

Which Medicare Supplement Insurance is Best?

Now that we’ve discussed the basics of Medigap Plans, let’s delve into what it takes to find the right plan.

With so many options available, it can be overwhelming to determine which plan is best for you.

- The first step in selecting a Medigap plan is understanding your personal healthcare needs and budget.

- When comparing plans, consider factors such as monthly premiums, deductibles, coinsurance/co-payments, and out-of-pocket maximums.

- Additionally, some plans offer additional benefits like vision or dental coverage. It’s important to evaluate all aspects before making a decision.

In our next section, we’ll discuss the differences between Medicare Advantage Plan Medigap Insurance and how they may impact your overall healthcare coverage.

What is the Best Medigap Plan?

Medicare Supplement Plans F, G, and N are the most popular Medigap plans due to their outstanding coverage and relatively low premiums.

For people new to Medicare, it comes down to Medigap Plan G and N as the best.

Anyone who enrolled in Medicare after January 1st of 2020 may not enroll in a Medigap Plan F.

Medigap Plan G

Medigap Plan G is one of the most popular Medigap plans available to seniors in the United States.

It offers comprehensive coverage that pays all but one of the gaps in Part A and B Medicare.

Plan G pays 100% of the gaps except for the Medicare Annual Part B deductible.

With Plan G, once you pay this deductible Medicare Part B will pay 80% of your medical bills, and Plan G will pay the remainder.

Medicare Advantage Plan Vs Original Medicare

When considering a plan, it’s important to understand the difference between Medicare and a Medicare Advantage Plan.

Original Medicare consists of Part A (hospital coverage) and Medicare Part B (medical coverage), while a Medicare Advantage Plan is offered by private insurance companies and is an alternative to Medicare.

Deciding between these options can be difficult, but ultimately depends on your individual needs and preferences.

While an Advantage Plan may offer more comprehensive coverage with additional benefits like vision or dental, some people prefer the flexibility and freedom of choice that comes with Medicare.

It’s important to compare both options before deciding which one is best for you.

Once you’ve made the decision to enroll in Medicare supplement insurance, there are several steps you’ll need to take.

- First, research and compare different plans available in your area to find the best medicare supplement insurance for your needs.

- Then, contact the provider of the chosen plan to enroll and begin receiving supplemental coverage alongside your existing Medicare benefits.

Enrolling In Medicare Supplement Insurance

After considering the differences between Medicare Advantage Plans and Original Medicare, you may have decided that a Medicare Supplement is the best option for your healthcare needs.

Choosing a Medigap plan can be overwhelming with so many options available.

Here are some factors to keep in mind when selecting a plan:

- Compare prices: Make sure you understand what each plan covers and how much it costs.

- Check coverage: Each plan offers different benefits, so make sure you choose one that meets your unique healthcare needs.

- Company reputation: Look at customer reviews and ratings before applying for coverage.

Once you’ve done your research and identified potential plans, it’s time to enroll in the best Medicare Supplement plan to fit your needs. You must be eligible for Medicare to enroll in this type of plan.

To enroll:

- Choose a plan: Select from the list of approved plans offered in your state.

- Contact an agent or insurer: They will provide information on available options and help you select a suitable policy.

- Enroll during the open enrollment period: This period lasts six months after you turn 65 years old or sign up for Part B.

By following these steps, you can ensure that you’re making an informed decision about finding the right Medicare supplement that fits your individual healthcare needs without breaking the bank on original Medicare costs.

Frequently Asked Questions

What is Medigap insurance?

Medigap insurance, also known as Medicare Supplement Insurance, is a type of health insurance that is sold by private insurance companies to supplement the coverage provided by Original Medicare.

What does Medigap insurance cover?

Medigap insurance covers certain out-of-pocket costs that are not covered by Original Medicare, such as deductibles, copayments, and coinsurance.

How do I enroll in Medigap insurance?

To enroll in Medigap insurance, you must first be enrolled in Original Medicare (Part A and Part B). You can then purchase a Medigap policy from a private insurance company in your state.

What are the benefits of having Medigap insurance?

The benefits of having Medigap insurance include having more comprehensive coverage for your healthcare expenses and potentially saving money on out-of-pocket costs.

Can I switch Medigap insurance plans?

Yes, you can switch Medigap insurance plans at any time. However, if you switch plans after your initial enrollment period, you may be subject to medical underwriting and could be denied coverage or charged higher premiums based on your health status.

What Are The Most Common Health Issues That A Medicare Supplement Can Cover?

The most common health issues that a Medicare supplement can cover are those not covered by Medicare. These may include deductibles, coinsurance, and copayments for hospital stays, skilled nursing care, and outpatient services.

In addition to these basic benefits, some supplements offer coverage for prescription drugs, vision care, dental care, hearing aids, and other healthcare expenses.

It is important to note that the specific benefits offered vary depending on the plan selected. Patients should carefully review their options before making a decision to ensure they choose a plan that meets their individual needs.

Can I Change My Medicare Supplement Plan At Any Time During The Year?

Yes, you have the option to change your Medicare supplement plan at any time during the year.

However, it’s important to note that making a switch outside of the open enrollment period may result in higher premiums or denied coverage for pre-existing conditions.

It’s recommended to review your current plan and compare it with other options available before making any changes.

Additionally, certain life events such as moving out of state or losing employer-sponsored coverage may qualify you for a special enrollment period where you can make changes to your Medicare supplement plan without penalty.

Are There Any Restrictions On Which Doctors Or Hospitals I Can See With A Medicare Supplement Plan?

Yes, there are restrictions on which doctors or hospitals you can see with a Medicare supplement plan.

However, these restrictions vary depending on the specific plan you choose.

Some plans limit your options to a network of providers, while others allow you to see any provider that accepts Medicare patients.

It’s important to carefully review the details of each plan before making a decision to ensure that it meets your healthcare needs and preferences.

How Do I Know If A Medicare Supplement Plan Is Worth The Cost For My Individual Situation?

Figuring out if a Medicare supplement plan is worth the cost for your individual situation can be overwhelming. It’s important to consider factors such as how often you visit healthcare providers, what medications you take, and any potential future health needs.

Additionally, it’s crucial to compare the costs of different plans and ensure that the benefits outweigh the premiums. Evaluating all of these factors will help you make an informed decision about whether or not a Medicare supplement plan is right for you.

How to Get Started

In conclusion, finding the right Medigap coverage can be overwhelming and confusing. However, it is important to take the time to understand your healthcare needs and compare different plans to find one that fits your individual situation.

When considering a Medicare Supplement plan, it’s important to evaluate which health issues are most common for you or your loved ones. This will help you choose a plan that covers those specific needs.

Additionally, while some plans may offer more flexibility with doctors and hospitals, others may have restrictions on which providers are covered.

It’s also essential to consider the cost of a Medicare Supplement plan versus its benefits. While these plans can provide additional coverage beyond Medicare, they do come at an extra cost. It’s crucial to weigh whether the added expenses are worth the potential savings in medical bills.

Overall, finding the right Medicare Supplement plan requires research and careful consideration based on your personal circumstances. By taking the time to evaluate your options thoroughly, you can make an informed decision that provides peace of mind for both yourself and your loved ones.

Updated December 4th, 2022