Blue Cross Blue Shield Medicare Supplement Plan G

Are you looking into Medigap policies to bolster your Medicare Part A or B?

Are you looking into Medigap policies to bolster your Medicare Part A or B?

Blue Cross Blue Shield Medicare Supplement Plan G offers you the most comprehensive coverage available. Plan G takes care of coinsurance, copayments, and excess charges, ensuring you don’t experience any unexpected medical costs during the year.

This post gives you a rundown of everything to do with Medigap Plan G. If you have any questions, contact our team at 1-888-891-0229.

We offer a free consultation to discuss the right Medigap Plan to suit your healthcare requirements. Alternatively, please fill out the contact form on this site, and one of our experts will call you back to discuss your requirements.

Who is Blue Cross Blue Shield?

Blue Cross Blue Shield (BCBS) is one of Americans leading health insurance providers. The company started as two separate entities, amalgamating their services in the 1940s before fully merging in the 1980s.

BCBS is now a conglomeration of 34 independent organizations operating in all 50 states across America and Puerto Rico.

The company caters to the healthcare requirements of over 114 million Americans, offering all Medigap policies in every category.

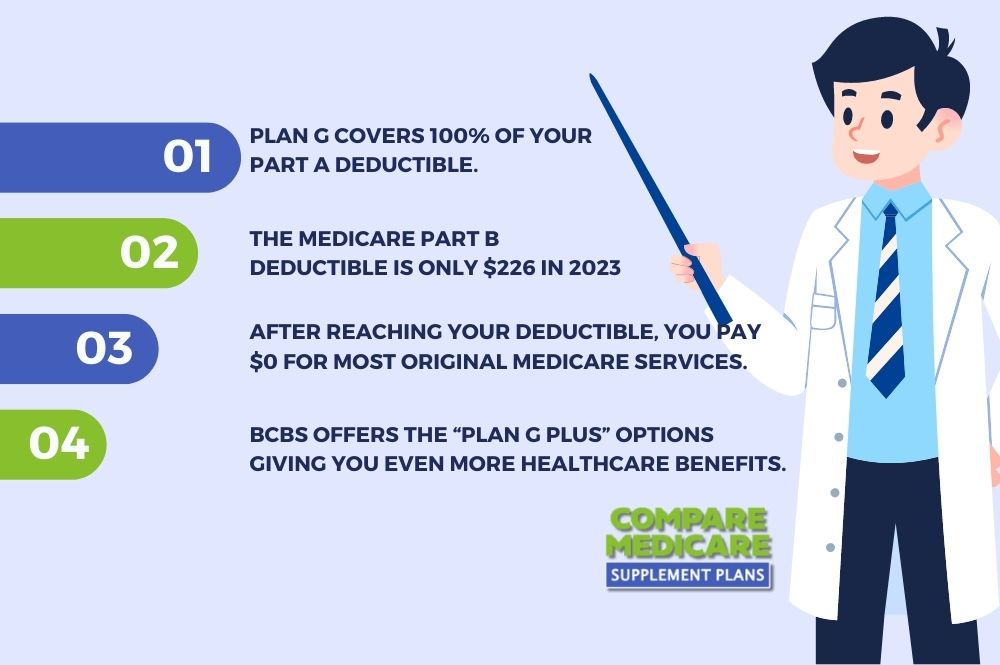

Blue Cross Blue Shield Medicare Supplement Plan G offers you almost all the advantages of Medigap Plan F but at a more affordable monthly cost.

With this Medicare supplement plan, you only need to meet your Medicare Part B deductible after paying your monthly premium.

Blue Cross Blue Shield Medicare Supplement Plan G – Highlights

Blue Cross Blue Shield Medicare Supplement Plan G – Overview

Doctors Network

See any doctor anywhere in the country. (Note, some standardized plans BCBS licensees offer require you to stay in-network. Fortunately, you pay a lower premium for this option).

Plan Deductible

Plan G covers your Original Medicare Part A deductible for hospitalization and specialized care. You will have to pay the Medicare Part B medical deductible.

Visits to the Doctor’s Office

After meeting your Medicare Part B deductible, Plan G pays all copays and coinsurance for visits to the doctor’s office.

Out-of-Pocket Maximums

There is no out-of-pocket maximum with Plan G.

Prescriptions

Plan G doesn’t cover prescriptions. However, you can include the “Prescription Blue℠ PDP Plan.”

Blue Cross Blue Shield Medigap Plan G Features

- Pays 100% of your Medicare copays and coinsurance for hospital, medical, and hospice services covered by Original Medicare Part A & B.

- Pays 100% of hospital costs for up to 365 days after using your Original Medicare benefits.

- Offers discounts on services and products through Blue365®.

- BCBS offers household discounts on premiums in selected states with selected providers.

You pay $0 for the following medical services covered by Original Medicare.

- Hospital Inpatient Care.

- Hospice Care.

- Skilled Nursing Facilities.

- Blood (First three pints).

- Ambulance Services.

- Medical Equipment.

- Chiropractic Services.

- Podiatry services.

- Renal Dialysis.

- Individual and group therapy.

- Occupational, speech, and physical therapy.

Urgent Care – You can access urgent care facilities for medical care if your illness or injury doesn’t require a visit to the emergency room or you can’t get to the doctor’s office.

Emergency care outside of the US – Pay a $250 deductible and 20% of the costs of medical services with a Lifetime maximum of $50,000.

Understanding Blue Cross Blue Shield Medigap Plan G Plus

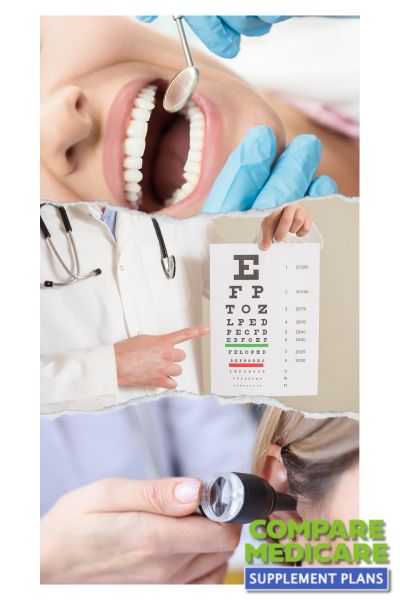

BCBS also offers “Medigap Plan G Plus,” a supercharged version of the standard Plan G. This package is available from select BCBS service providers and in select states. With Plan G Plus, you get many other additional benefits.

For an additional $22.22 a month, you can add vision, dental, and hearing coverage to your Medicare Supplement Plan G. Plan G Plus offers you the following.

For an additional $22.22 a month, you can add vision, dental, and hearing coverage to your Medicare Supplement Plan G. Plan G Plus offers you the following.

- In-network dental examinations, X-rays, cleanings, and fluoride treatment are free.

- In-network vision coverage, including standard lenses, every year.

- One hearing exam every year and up to a 60% saving on the average retail price of hearing aids from a TruHearing® provider.

Current Blue Cross Medicare Supplement Plan G members, and Legacy Medigap members, can enroll for the Dental Vision Hearing Package between February 1 and April 30 every year.

Plan G Plus also includes a 24/7 Nurseline, with nurses available 24/7/365. The nurse line assists with general health inquiries, providing trusted guidance on urgent and emergency care, and more.

Members also get access to an audio library containing information on over 1,000 health topics ranging from women’s health to allergies. The library also has over 600 topics available in Spanish.

SilverSneakers®† Fitness Program

Plan G Plus also allows members to access the “SilverSneakers” fitness program for seniors. You get access to more than 16,000 fitness centers across the national network.

- Specialized fitness classes by a professional instructor designed for people of all fitness levels and abilities.

- Low-impact workout classes focus on improving your endurance, strength, flexibility, mobility, coordination, and agility.

- FLEX classes like dance and yoga at fitness clubs, recreation centers, and in parks.

Is BCBS Medigap Plan G Plus Worth It?

It’s reasonable to assume you can save anywhere from $785 to $1,729 annually utilizing all the additional benefits of Medigap Plan G. The cost difference between the standard BCBS Plan G and Plan G Plus is approximately $22.22 per month or $266.64 annually.

- Average Plan G Premium: $120.18

- Average Plan G Plus Premium: $142.40

Consider the costs of the following medical services and how Plan G Plus can save you money on your annual healthcare expenses.

- The average cost of dental cleaning is $75-$400 (Two annual cleanings).

- The average dental exam cost is $60 to $120 (Two yearly exams).

- The average price of dental X-rays is $50 to $100.

- The average cost of a vision exam is $100 to $200.

- $130 in-network and $65 out-of-network annual eyewear allowance.

- The average price of a hearing exam is $125.

- Comparative cost for access to the 24/7 nurse line: $75 per visit.

- Relative cost for the SilverSneakers® Fitness Program⁹: $35 to $59 per month.

Getting a cost estimate on dental restorative services and non-surgical dental extractions is challenging, but you get coverage of 50% and 75%, respectively.

Overall, the benefits offered with Plan G Plus are approximately $785 to $1,729 per year.

BCBS Plan G plus will be one of their most popular Medigap plans for 2024.

Frequently Asked Questions

Who is eligible to enroll in Blue Cross Blue Shield Medicare Supplement Plan G?

To be eligible for Blue Cross Blue Shield Medicare Supplement Plan G, individuals must be enrolled in Medicare Part A and Part B. Eligibility is generally based on age, with individuals aged 65 and older qualifying for Medicare.

When can I enroll in Blue Cross Blue Shield Medicare Supplement Plan G?

You can enroll in Blue Cross Blue Shield Medicare Supplement Plan G during your Medigap Open Enrollment Period, which begins when you are 65 years old and enrolled in Medicare Part B. This period lasts for six months and provides guaranteed access to Medigap plans without medical underwriting.

What are some advantages of choosing Blue Cross Blue Shield Medicare Supplement Plan G?

Blue Cross Blue Shield Medicare Supplement Plan G offers various advantages, including comprehensive coverage for deductibles, copayments, and coinsurance not covered by Original Medicare. It also allows you to see any doctor or specialist who accepts Medicare patients, and there are no network restrictions.

How does Blue Cross Blue Shield Medicare Supplement Plan G differ from Plan N?

While both Blue Cross Blue Shield Medicare Supplement Plan G and Plan N offer robust coverage, the main difference lies in the cost-sharing responsibilities. Plan N typically requires copayments for certain services like doctor visits and emergency room visits, while Plan G covers those costs entirely.

What types of coverage are included in Blue Cross Blue Shield Medicare Supplement Plan G?

Blue Cross Blue Shield Medicare Supplement Plan G provides coverage for Medicare Part A coinsurance and hospital costs, Medicare Part B coinsurance or copayments, skilled nursing facility care coinsurance, and more. It may also cover foreign travel emergency expenses up to plan limits.

Are prescription drugs covered under Blue Cross Blue Shield Medicare Supplement Plan G?

No, Blue Cross Blue Shield Medicare Supplement Plan G does not include prescription drug coverage. To obtain coverage for prescription drugs, you can enroll in a standalone Medicare Part D prescription drug plan.

Can I switch to Blue Cross Blue Shield Medicare Supplement Plan G from another insurance provider’s plan?

Yes, it is possible to switch to Blue Cross Blue Shield Medicare Supplement Plan G from another Medigap plan offered by a different insurance provider. However, eligibility and underwriting rules may apply, so it’s advisable to review the specific guidelines and consult with a licensed insurance agent.

Where can I find more information about Blue Cross Blue Shield Medicare Supplement Plan G?

To access more information about Blue Cross Blue Shield Medicare Supplement Plan G, you can visit the official Blue Cross Blue Shield website, contact their customer service directly, or consult with licensed insurance agents who specialize in Medicare coverage.

Are there any additional benefits associated with Blue Cross Blue Shield Medicare Supplement Plan G?

Blue Cross Blue Shield Medicare Supplement Plan G offers benefits such as coverage for excess charges in Medicare Part B, coverage for additional hospitalization days beyond what Original Medicare provides, and potential access to wellness programs or additional services that Blue Cross Blue Shield may offer.

How can I compare the costs and premiums of Blue Cross Blue Shield Medicare Supplement Plan G?

To compare the costs and premiums of Blue Cross Blue Shield Medicare Supplement Plan G, you can request quotes from Blue Cross Blue Shield and other insurance providers. Additionally, working with a licensed insurance agent who specializes in Medicare can help you evaluate different options and find the most suitable coverage for your needs.

Medicare Supplement Plans - How to Apply

The easiest way to get started is to call us today at 1-888-891-0229.

We’ll answer all of your questions and help you find the right Medicare plan. Or you can use our FREE quote engine to begin shopping today!