What Do Medicare Supplement Plans Cover?

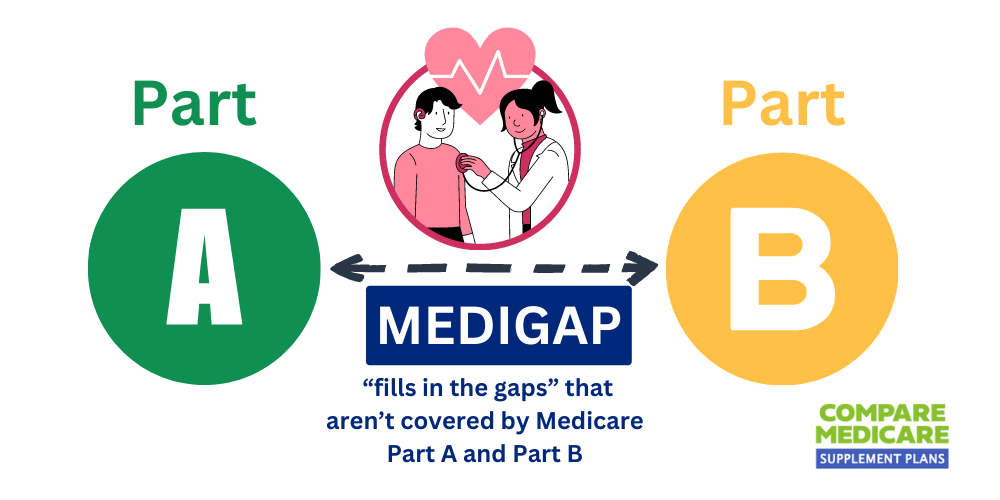

Do you have Original Medicare Parts A & B? You might notice that these health insurance policies only cover 80% of your healthcare costs, leaving you with the additional out-of-pocket expenses associated with inpatient and outpatient care and treatment.

Fortunately, you can bridge the gap with a supplemental Medicare policy designed to reduce your annual healthcare expenses.

What does Medicare supplement cover?

This post gives you the answers you need to understand how Medigap works, what it covers, and the premiums associated with the policies.

You Can Rely on the Experts to Help You Choose the Right Medigap Plan

If you’re having trouble finding the right Medigap plan to suit your needs, contact us at 1-888-891-0229 to speak to an expert.

Our team of licensed professionals is ready to give you the rundown on the different plans and help you choose the right plan for your healthcare requirements and budget.

If you can’t call us right now, fill out the contact form on this site.

We’ll call you back at a time that’s convenient for you to discuss your needs. Our brokers are experts in Medigap.

We can recommend the best provider in your state with the most affordable rates and the best discounts.

What is Medigap?

Medigap is a supplement healthcare insurance policy filling the gaps in your healthcare costs. It’s available to beneficiaries enrolled in Medicare Parts A & B.

Medigap covers the other expenses that Original Medicare doesn’t, such as deductibles, copayments, coinsurance, and excess charges.

There are ten standard Medigap policies, A, B, C, D, F, G, K, L, M, and N.

Plan F & C are now unavailable to members that enroll in Medicare after January 1, 2020.

However, if you were eligible for Medicare before this date, you could apply for Plan F or C, but you’ll have to undergo medical underwriting before an insurer accepts you to their scheme.

The rest of the plans are readily available to new Medicare members, each offering a different level of coverage for your out-of-pocket medical expenses.

The level of coverage they provide determines the premiums you pay monthly for the policy.

So, you can choose the right Medigap policy to suit your medical requirements and budget.

What’s the Difference Between Medigap Plans?

Each of the ten Medigap plans offers you a different level of coverage for inpatient and outpatient medical expenses not covered by Original Medicare Parts A & B.

The differences between the plans are the level of coverage they provide to your out-of-pocket costs and the monthly premiums they charge to remain a beneficiary of the plan.

New Original Medicare members often have a hard time assessing all the deductibles, coverage, benefits, and premiums associated with these plans.

That’s why it helps to have a professional team working for you to help you choose the right plan for your healthcare requirements.

What Do Medicare Supplement Plans Cover?

Let’s look at what each of the Medigap plans offers you regarding coverage for your medical expenses.

While every plan has a unique set of benefits, they’re all standardized by the Federal government.

Despite being sold by private insurers across America, Medigap plans all offer beneficiaries the same coverage, albeit at different price points.

All Medigap plans cover a portion, if not all, of the following:

- Medicare Part A hospital fees and coinsurance.

- Medicare Part A hospice copayment or coinsurance costs.

- Medicare Part B copayment or coinsurance costs.

- Up to the first three pints of blood used in blood transfusions.

Additionally, some Medigap plans also offer the following extra cover to beneficiaries.

- Skilled nursing facility coinsurance and copayment costs.

- Medicare Part A deductible.

- Medicare Part B excess charges.

- 80 % of emergency medical costs during foreign travel.

Medigap plans don’t cover the costs of your prescriptions. Nor do they offer coverage for preventive healthcare costs, such as visits to an acupuncture therapist or physiotherapist.

Medigap also doesn’t cover the costs of vision, dental, and hearing exams, assessments, and treatments.

Medicare Advantage is not the same thing as Medigap, and both options offer different levels of coverage.

Medicare Advantage plans provide additional coverage above what Original Medicare offers. Medigap plans help with paying for the existing coverage you already have.

While most states have standardized benefits available to Medigap policyholders, Wisconsin, Massachusetts, and Wisconsin, standardize Medigap policies differently and have different plan names.

How Much Does a Medigap Insurance Plan Cost?

Private insurers, like Humana, Blue Cross Blue Shield, and Cigna, offer Medigap plans.

While it’s a Federally regulated healthcare product offering a standardized level of benefits to beneficiaries, insurers don’t have to adhere to standardized pricing for the plans.

While it’s a Federally regulated healthcare product offering a standardized level of benefits to beneficiaries, insurers don’t have to adhere to standardized pricing for the plans.

As a result, some healthcare providers are more expensive in their monthly premiums than others.

For instance, Humana might be the most affordable provider in one state but the most expensive option for the same plan in another.

That’s why you need an experienced, professional broker assisting you with finding the most affordable option in your state for the plan you want.

Some Medigap providers offer different additional benefits to their beneficiaries, such as household discounts, gym memberships, and meal delivery services.

We can assist you with finding the provider with the best rates and additional benefits to fulfill your healthcare and budget requirements.

Medigap providers also use personal factors when setting premium prices:

- For instance, a man usually pays more for their premium than a woman.

- Whether or not you smoke will also determine your premium costs, and your age also plays a role in determining your premium.

- Many insurers will increase your premiums as you age.

How Do I Enroll in a Medigap Plan?

You can enroll for Medigap after joining Medicare Parts A & B.

You can enroll for Medigap after joining Medicare Parts A & B.

There’s an open enrollment window that opens for six months starting from the day of your 65th birthday.

If you enroll during the window, the insurer has to accept your application, even if you have a pre-existing health condition.

However, if you miss the window and enroll outside the first six months, the insurer might require you to undergo medical underwriting.

Underwriting is where the provider assesses your health and the risk you present to their business.

If you have a pre-existing condition, they may decide to charge you a higher premium or deny you the plan.

Frequently Asked Questions

What are Medicare Supplement Plans?

Medicare Supplement Plans, also known as Medigap plans, are private insurance policies designed to supplement the coverage provided by Original Medicare (Part A and Part B).

What do Medicare Supplement Plans cover?

Medicare Supplement Plans cover the gaps in coverage left by Original Medicare. This can include copayments, deductibles, coinsurance, and other out-of-pocket expenses.

Are prescription drugs covered by Medicare Supplement Plans?

No, Medicare Supplement Plans do not cover prescription drugs. To get prescription drug coverage, you need to enroll in a separate Medicare Part D plan.

Do Medicare Supplement Plans cover vision and dental care?

In most cases, Medicare Supplement Plans do not cover routine vision and dental care. However, some plans may offer limited coverage for vision and dental services related to a medical condition.

Are pre-existing conditions covered by Medicare Supplement Plans?

Yes, Medicare Supplement Plans are required to cover pre-existing conditions. However, there may be a waiting period before the coverage begins for certain conditions.

Do Medicare Supplement Plans cover medical expenses while traveling abroad?

Some Medicare Supplement Plans provide limited coverage for emergency medical care during foreign travel. However, this coverage is typically limited to a certain amount and duration.

Can I choose any doctor or hospital with a Medicare Supplement Plan?

Yes, you can generally choose any doctor or hospital that accepts Medicare patients. Medicare Supplement Plans do not restrict your choice of healthcare providers.

Do Medicare Supplement Plans cover long-term care or nursing home expenses?

No, Medicare Supplement Plans do not cover long-term care or nursing home expenses. They primarily focus on covering the costs associated with Medicare-approved medical services.

Are preventive services covered by Medicare Supplement Plans?

No, preventive services are covered by Original Medicare (Part B). Medicare Supplement Plans do not provide additional coverage for preventive care.

How do I compare different Medicare Supplement Plans?

To compare Medicare Supplement Plans, you can review the benefits and costs offered by different insurance companies by entering your zip code above. Or call us today at 1-888-891-0229.

What Do Medicare Supplement Plans Cover?

When it comes to shopping for Medicare Supplement plans, there are many different choices available which can get confusing.

We’ll compare the rates from the top companies in your area to help save you the most money possible.

Call us today to get started!

Updated December 4th, 2022