North Carolina Medicare Supplement Plans 2024

Spending your retirement on the eastern seaboard is a popular choice for many Americans.

Spending your retirement on the eastern seaboard is a popular choice for many Americans.

The Tar Heel State has plenty of amazing scenery to admire as you enjoy your golden years. It’s critical for seniors to ensure they have adequate financial planning for their retirement, and Medicare gives you a way to bring more predictability and security to your healthcare expenses as you age.

The issue with Original Medicare Parts A & B is that it doesn’t cover all your medical and hospitalization costs. You get 80% coverage for your inpatient and outpatient expenses, leaving you with a 20% balance to pay. If you’re living on a fixed income, you can’t afford surprises with healthcare expenses.

Medicare supplement plans, or “Medigap,” covers the shortfalls left behind by Original Medicare. These plans come in a variety of options, with each offering a different level of coverage.

North Carolina Medicare Supplement Plans have average premiums of around $108 and vary depending on the plan you choose.

This post unpacks the cost, benefits, and coverage of Medigap plans. We’ll help you make an informed decision on the right supplemental policy to support your out-of-pocket healthcare expenses.

The Best Medicare Supplement Plans in North Carolina for 2024

Medigap plans in 2024 are available from leading healthcare insurers in North Carolina. Here are some of the top-rated firms offering Plans F, G, & N.

- Aetna

- Liberty Bankers

- AFSLIC

- Assured Life

- Atlantic Coast Life

- Bankers Fidelity

- Blue Cross Blue Shield of North Carolina

- Cigna

The Best Provider for Medicare Supplement Plan G in North Carolina – Aetna

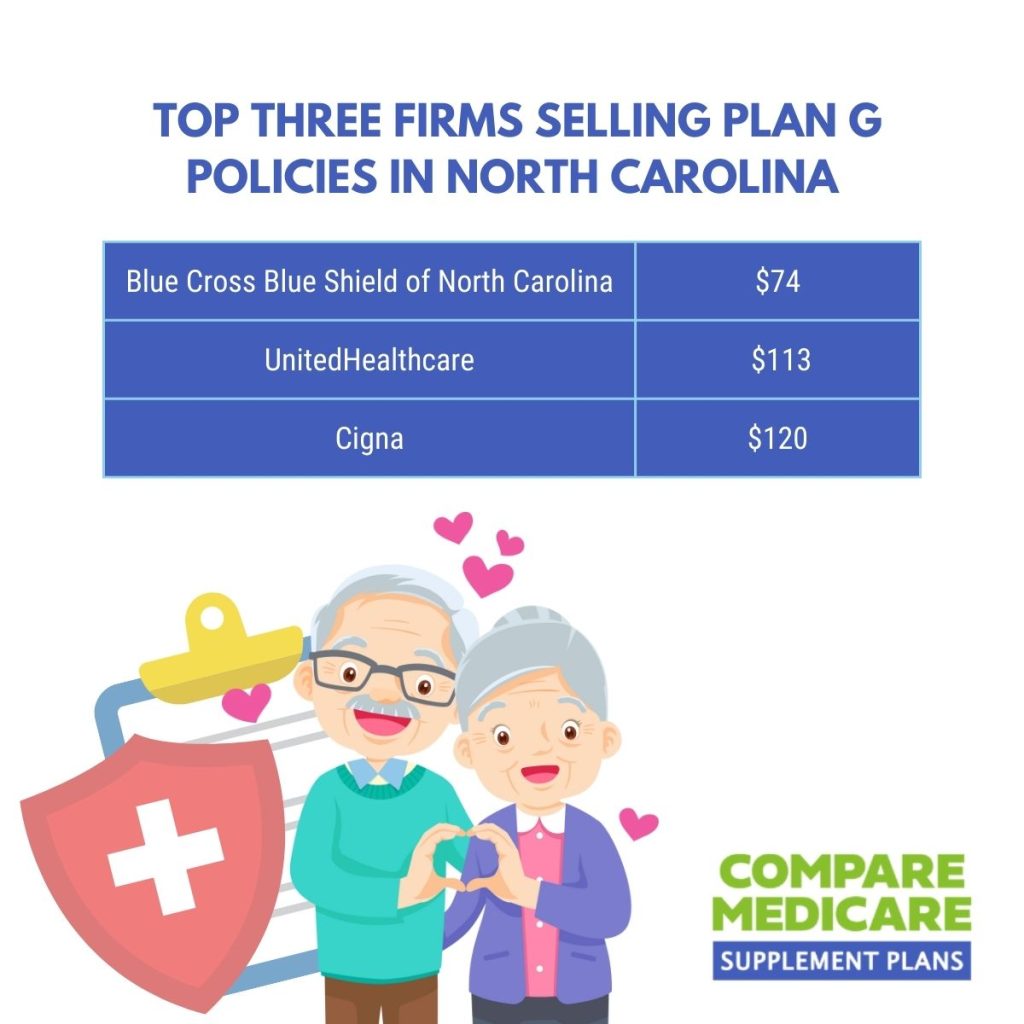

There are 44 insurers offering Plan G in North Carolina. The best option for Plan G in the state is Blue Cross Blue Shield of North Carolina, with a monthly premium of $74.30. The industry average for Medigap Plan G is $107.50 across all provides, making BCBS more affordable by $33.20 per month. That’s a huge saving.

Cigna is the most expensive provider for Plan G in North Carolina, with average premiums being $119.80 per month. Aetna also offers a High-deductible version of Plan G. The HD version increases the annual Part A deductible from $1,600 to $2,700, but you benefit by paying a lower monthly premium.

The HD version of Plan G is ideal for healthy seniors that want good medical coverage in emergencies, but lower monthly premiums. The average cost of HD Plan G from Aetna is $41 per month. The top three firms selling Plan G policies in North Carolina are the following.

What Does Plan G Cover?

Medigap Plan G offers you the most comprehensive level of coverage after Plan F. However, Plan F is no longer available to people eligible for Medicare after January 1, 2020. The difference between Plan G & F is that Plan F covers the Part B deductible. However, the lower premiums from Plan G offset this, making it as economically viable as Plan F.

Here are the standardized benefits of Plan G. However, most providers offer additional benefits and perks for providers covering vision, hearing, and dental services. Many providers also offer household discounts and discounts for paying through automatic payments or paying all your premiums for the year up front. Speak with us and we’ll get you the best deal on Plan G.

- Part A coinsurance and hospital costs up to an additional 365 days after using up your Medicare benefits.

- Part B coinsurance or copayment.

- Blood (first 3 pints).

- Part A hospice care co-insurance or copayments.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B excess charges.

The Best Provider for Medicare Supplement Plan N in North Carolina – Aetna

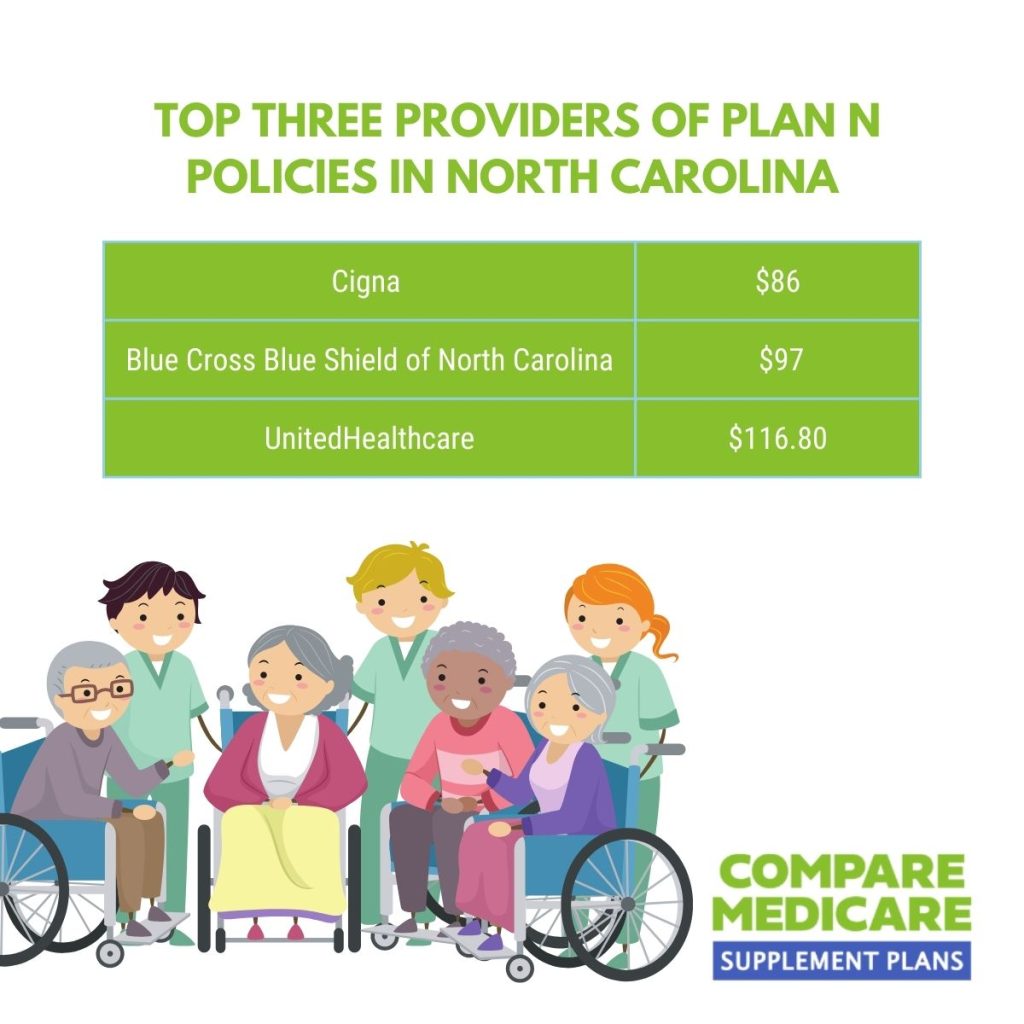

There are 43 insurers offering Plan N in North Carolina. Cigna is the best provider for your Plan N policy, with a monthly premium of $85.67. The average cost of Medicare Supplement Plan N is $101 per month in North Carolina, across all providers. So, you get a saving of $15.33 off the median rate by taking your policy with Cigna.

The most expensive provider of Plan N in North Carolina is UnitedHealthcare (AARP). With a Plan N policy costing an average of $116.80 per month. The top three providers in the state have the following average premiums for Plan N.

What Does Plan N Cover?

Medigap Plan N offers comprehensive coverage for medical emergencies and a low monthly premium. However, you’ll have to make copayments at the doctor’s office and when visiting the emergency room. You’ll pay $20 with the doctor, and $50 at the emergency room, with the $50 copayment being waived if the doctor admits you to the hospital.

Plan N also doesn’t cover Part B excess charges. If you see a practitioner charging more than Medicare-approved rates, you’re liable for the extra charges. Here are the standardized benefits of Plan N.

- Part A coinsurance and hospital costs up to an additional year after your Medicare benefits

- Part B coinsurance or copayments.

- Blood (first 3 pints).

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care insurance.

- Part A deductible.

80% of foreign travel exchange (up to plan limits).

Frequently Asked Questions

Who is eligible for North Carolina Medicare Supplement Plans?

North Carolina Medicare Supplement Plans are available to individuals who are already enrolled in Medicare Part A and Part B. Eligibility requirements include being 65 years or older or having certain disabilities.

When can I enroll in North Carolina Medicare Supplement Plans?

The best time to enroll in North Carolina Medicare Supplement Plans is during your Medigap Open Enrollment Period, which starts when you are 65 years old and enrolled in Medicare Part B. This period lasts for six months and guarantees you access to any plan without medical underwriting.

What are the best Medicare Supplement Plans available in North Carolina?

The best Medicare Supplement Plans in North Carolina depend on your specific healthcare needs and budget. Popular options include Plan F, Plan G, and Plan N. Plan G and Plan N are particularly favored as they offer comprehensive coverage at more affordable premiums compared to Plan F.

What is the difference between Medicare Plan G and Medicare Plan N?

The main difference between Medicare Plan G and Plan N is that Plan N requires you to pay certain copayments or coinsurance for doctor visits, emergency room visits, and some hospital stays. Plan G, on the other hand, covers these costs completely. Both plans provide extensive coverage and are highly regarded by Medicare beneficiaries.

What does coverage with North Carolina Medicare Supplement Plans include?

North Carolina Medicare Supplement Plans provide coverage for various healthcare costs not covered by Original Medicare, such as deductibles, copayments, and coinsurance. The specific coverage depends on the plan you choose but generally includes hospital stays, medical procedures, skilled nursing facility care, and other eligible expenses.

What benefits do North Carolina Medicare Supplement Plans offer?

North Carolina Medicare Supplement Plans offer benefits such as coverage for Medicare Part A and Part B coinsurance, coverage for additional hospitalization days, coverage for skilled nursing facility care, and coverage for emergency medical services received outside the United States (up to plan limits).

Can I switch from a different Medicare Supplement Plan to a North Carolina plan?

Yes, you can switch from one Medicare Supplement Plan to another, including switching to a North Carolina plan. However, eligibility and underwriting rules may apply depending on the timing and circumstances of the switch.

Are prescription drugs covered under North Carolina Medicare Supplement Plans?

No, North Carolina Medicare Supplement Plans do not include prescription drug coverage. To get prescription drug coverage, you can enroll in a standalone Medicare Part D prescription drug plan.

How can I find the best North Carolina Medicare Supplement Plans for 2024?

To find the best North Carolina Medicare Supplement Plans for 2024, it is advisable to compare plans from different insurance providers. You can use our FREE online quote engine to get started, found to the right on this page.

Where can I find more information about North Carolina Medicare Supplement Plans?

For more information about North Carolina Medicare Supplement Plans, call us today at 1-888-891-0229 and speak with one of our licensed insurance agents specializing in Medicare coverage.

Use Us to Find the Best Medicare Supplement Plans in North Carolina

Our fully licensed Medigap experts are available to you at 1-888-891-0229. Call us for a free consultation and quote. We’ll give you the advice you need to find the right Medigap plan for you and your budget. Or you can leave your details on our contact form and we’ll get a professional agent to call you back to discuss your needs.

Updated June 7th, 2023