Medicare Supplement Plan F

For years, Medicare Supplement Plan F has been the most popular Medigap plan. Medicare Plan F has the most coverage of all the plans, but not everyone is eligible to enroll. Keep reading to see if Medigap Plan F is an option for you.

Medicare Supplement plans (Medigap) offer great coverage for people enrolled in Medicare Part A and Part B. There are four main parts of medicare:

- Medicare Part A (Hospital coverage)

- Medicare Part B (Doctor’s services_

- Medicare Part C (Medicare Advantage plans)

- Medicare Part D (Prescription drug coverage)

What is Medicare Supplement Plan F?

Medigap plans are also designated in what are called “plan letters”, and they run A – N.

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available and offers 100% coverage of the gaps in Medicare.

Medicare gaps are:

- Deductibles

- Copays

- Coinsurance

You are required to pay these gaps, or if you enroll in a Medicare Plan F they will be paid 100% for you.

Medicare Supplement Plan F is a type of insurance policy offered by private insurers to supplement Original Medicare (Part A and Part B). It helps cover the out-of-pocket expenses that come with Original Medicare, such as deductibles, coinsurance, and copayments.

In addition to providing coverage for these costs, Medicare Supplement Plan F may also offer additional benefits not covered under Original Medicare. For people enrolled in Medicare who want extra peace of mind in their health care coverage, this plan can be an excellent choice.

Medicare Supplement Plan F Coverage

Medicare Supplement Plan F provides comprehensive coverage for most medical services and supplies that are covered under Original Medicare.

This includes hospitalization, doctor visits, and preventive care services like annual wellness exams, laboratory tests, and imaging scans. Additionally, it covers all remaining costs including all deductibles under Part A and Part B of Original Medicare – as well as co-insurance payments up to 100%.

This means you will pay nothing out-of-pocket for those services beyond your monthly premium.

With Medicare Supplement Plan F:

- Pay the monthly premium

- All Medicare-approved expenses are paid 100%

- There is no network; Doctors must just accept Original Medicare

- No referrals needed to see a specialist

Who is Eligible for Medicare Plan F?

Although Medicare Supplement Plan F is the highest coverage Medigap plan available, not everyone is eligible to enroll in it.

Only those enrolled in Medicare prior to January 1st of 2020 may enroll in a Medicare Plan F. This is because Plan F offers what is called “first dollar coverage”. This means the plan will pay 100% of the gaps in Medicare from Day 1, with no out-of-pocket expense from the plan holder.

Because of this, many people have over used their coverage and made it very expensive for insurance companies and medical providers. Therefore, Medicare Plan F is no longer offered to people new to Medicare. That being said, there are other great alternatives that can actually save you more money over Medigap Plan F.

What does Medicare Plan F Cover?

Medicare Plan F provides the following coverage:

- Medicare Part A deductible and coinsurance (up to an additional 365 days after Medicare benefits are used)

- Hospice care coinsurance or copays

- Skilled nursing facility coinsurance

- Medicare Part B deductible

- Medicare Part B coinsurance

- Medicare Part B excess charges

- First three pints of blood

- Foreign travel emergency benefit (up to a $ 50,000 lifetime benefit after a $250 deductible)

Medicare Supplement Plan F pays 100% of the gaps in Medicare. There are no copays, no deductibles, and no coinsurance to pay beyond your monthly premium.

What is not covered under Medicare Plan F?

As comprehensive as Medicare Plan F is, there are services it does not cover, such as:

- Medicare Prescription drug coverage

- Dental, vision, or hearing benefits

- Cosmetic surgery

If Medicare Parts A and B pay first, then Medicare Supplement Plan F will pay the difference. Therefore, services must simply be a “Medicare-approved” expense.

Medicare Plan F Costs

As you can likely imagine, with all this great coverage that Medicare Plan F provides, there is a monthly premium that goes along with it. And Medicare Plan F has the highest premium of all the Medigap plans.

It’s very important to note that Medicare Supplement plans are standardized by the government. This means that every insurance company must offer the exact same plan letters and benefits within those letters. For example, an Aetna Medicare Supplement Plan F is identical to a Mutual of Omaha Plan F.

Their rates however are entirely different for the exact same coverage. This is how we can help, by shopping all the top companies for you to determine which plan and which company is your best option.

- Age

- Zip code

- Gender

- Tobacco use

- Any household discounts that might apply

Because of these factors, the cost of a Medicare Plan F policy will be much different in California than it would be in North Carolina. As well, a 65-year-old Female will pay less than a 65-year-old Male.

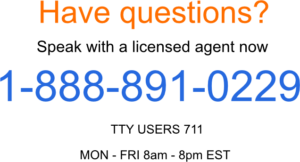

You may use our FREE online quote engine by filling out the form to the right to see the rates for Medicare Plan F in your area. Or call us today at 1-888-891-0229.

Medicare Supplement Plan F for 2024 – A good option?

With the rising cost of everything in this country, more and more people will be looking to save money in every way they can. This includes searching for lower-cost Medigap insurance and possibly switching plans.

Because Medicare Supplement Plan F is the highest-cost plan, going into 2024 would be a good time for most people to research changing to a Medicare Plan G, or even Plan N to save money. We can help see if changing plans is a good idea for you.

You can view rates for Medicare Supplement Plans in 2024 by filling out the form to the right as we get closer to September.

Medicare Plan F vs Plan G

Due to the high cost of Medicare Plan F, many people are looking to other Medigap plans that still provide great coverage at a lower cost.

One of these plans is Medicare Supplement Plan G. Medicare Plan G is nearly identical to Plan F, except on Plan G you pay the annual Medicare Part B deductible out of pocket yourself. This deductible is once per year and resets each January.

Currently, the Medicare Part B deductible is $226 for 2023. With Plan G, once this is met the plan pays 100% of the gaps in Medicare Part A and B just like Plan F. The benefit, however, is that Medicare Plan G is lower in monthly premiums than Plan G.

Many people are switching from Medicare Plan F to Plan G to save money and simply pay the annual deductible themselves. By entering your information into the form on the right, you can see the difference in cost between Medicare Plan F and G in your area.

Which is better Medicare Plan F or Plan G?

Medicare Plan F and Plan G are two of the most popular Medicare plans on the market, both offering comprehensive coverage for healthcare. For many seniors, making the decision between these two plans can be difficult, as each has its own unique set of benefits and drawbacks.

When considering which plan is right for you, it’s important to understand the differences between them. Plan F is a traditional Medicare Supplement plan that covers virtually all out-of-pocket expenses associated with Original Medicare, such as copayments, coinsurance, and deductibles. This makes it an ideal choice for seniors who have a high risk of needing medical care in the future.

Medicare Plan G is similar to Plan F but does not cover the Part B deductible (which is currently $226 per year). The benefit of this plan is that premiums tend to be lower than those for Plan F.

Ultimately, choosing between Medicare Plan F and Plan G comes down to your individual needs and circumstances. In nearly every case, you will save money by enrolling in Medicare Plan G and paying the deductible yourself.

Before making your final decision about which plan is best suited for your needs, give us a call at 1-888-891-0229. We can help assess your specific situation and provide unbiased advice about which option makes sense for you.

Enrolling or Changing Medicare Supplement Plans

Enrolling in a Medicare supplement plan with us is quite easy. Shopping for one on your own, however, can be quite difficult and overwhelming.

Remember, every insurance company has the exact same plans but charges different rates for them. If you were to call each company on your own searching for the lowest premium, you’ll likely be met with sales agents who will try to sell you only their plan, because that’s all they have to offer. The plan from the company they work for.

We work for YOU, and it’s FREE.

At no cost to you, we’ll shop all the rates from the top companies to find a plan to fit your needs at an affordable rate.

We are independent insurance agents that will shop the rates for you each year and help you find the plan that fits your needs. And it won’t cost you a dime.

To get started, just give us a call today.

Updated December 4th, 2022