How Can Medicare Supplement Plans Cost Nothing?

Nearly half of all Medicare beneficiaries (28 million people) are enrolled in a Medicare Advantage plan as of 2022.

Medicare Advantage helps beneficiaries of Original Medicare Parts A & B cope with the additional out-of-pocket costs associated with their healthcare.

If you search online forums, you might see people discussing how you can get a free, zero-premium Medicare Advantage plan – Is that a real thing? Since when do companies give anything away for free?

Well, it’s true. Some Medicare Advantage policies come with zero monthly premiums, meaning you don’t have to pay anything to enroll or remain enrolled in the scheme.

How can Medicare Supplement plans cost nothing? Is there a catch to it, and why doesn’t everyone do it?

There is something of a “catch” involved with a zero-premium MA plan. You’ll still have to make copayments, coinsurance, and deductible payments to remain enrolled.

In this post, we’ll discuss the specifics of zero-premium Medicare Advantage plans and how to get one if it’s available in your state.

Medicare Advantage Plans at a Glance

The Medicare Advantage plan, also known as Medicare “Part C,” allows Medicare-approved private providers (healthcare companies) to offer policies providing beneficiaries their Part A & B benefits associated with Original Medicare.

Therefore, a zero-premium MA plan, like other MA plans offering no copays, may include coverage for prescription medications. Plans may also cover additional healthcare costs, like dental services.

The Federal Medicare program pays private healthcare insurance companies a fixed amount to provide their clients with Original Medicare Parts A & B.

Any funds leftover from these programs go towards funding zero-premium policies for qualifying beneficiaries.

Medicare Advantage zero premium plans have specific rules regarding Medicare costs.

However, some providers have flexibility in setting cost-sharing amounts and premiums. The same applies to Medicare Advantage plans.

Contact Us for Advice on Medigap and Medicare Advantage Plans

If you’re wondering how to access a Medicare Advantage plan with zero-premiums, speak to the experts.

Call us at 1-888-891-0229 for a free consultation, or fill out the contact form on this site. We’ll connect you with a Medicare expert to answer all your questions.

Compare Plans & Rates

Enter Zip Code

How Can a Medicare Advantage Be Free?

So, how can Medicare supplement plans cost nothing? These plans come with specific terms and conditions for policyholders, such as restrictions on using only the provider’s network.

In this case, you might not be able to carry on visiting your usual primary care physician for consultations.

Different plans have different flexibility options around going for doctor visits in or out of the provider’s network.

So, you’ll need to call your provider before visiting a physician out-of-network. Another thing to bear in mind is that MA premiums can increase annually.

As a result, you might get your first year free but then have to pay a premium in your second year with the provider.

The provider may also add or remove certain benefits from the plan annually as they see fit.

Do Medicare Advantage Policies Have Premiums?

Most Medicare Advantage plans include coverage for prescription medications (MA-PDs).

The share of MA-PDs charging zero premiums (other than the premium for Part B) increased from 59% to 66% for 2023.

Additionally, 17% of Medicare Advantage plans have some level of reduction in Part B premiums in 2023. 99% of beneficiaries also have access to MA-PD plans featuring zero monthly premiums in 2023.

However, it’s important to note residents of Alaska don’t have any access to zero-premium MA-PDs.

The CMS announced that the average monthly plan premium was expected to be $18 per month for all Medicare Advantage beneficiaries in 2023.

This includes beneficiaries paying no premiums for their Medicare Advantage plan.

What are the Other Costs Involved with Free Medicare Advantage Policies?

So, just because a provider offers a zero-premium MA plan in your area doesn’t mean it’s necessarily the best option for a supplemental Medicare plan.

Medicare Advantage plans sometimes come with additional fees, such as:

- deductibles,

- copayments,

- and coinsurance,

- and can feature different additional benefits.

Coinsurance and copayments are cost-sharing programs requiring beneficiaries to pay amounts toward the healthcare services they use. For instance, a MA plan might cover 80% of the cost of visiting your physician for a consultation. In this case, you would have to pay the additional 20% coinsurance charge.

The deductible is the amount you’ll pay annually for healthcare services before the plan activates and begins to cover your medical costs. For instance, if the plan has an annual deductible of $700, and you spend $700 on healthcare services in a year, the deductible amount rests the following year.

So, you could pay $700 out-of-pocket for healthcare costs every year without receiving any benefit from the plan. All plans usually feature copayments, coinsurance, and deductibles, at varying amounts.

Bear this in mind when you’re comparing zero-premium Medicare Advantage plans between providers.

What Else You Need to Know about No-Premium Medicare Advantage Policies

Medicare Advantage plans, unlike Original Medicare, feature out-of-pocket spending limits on your annual healthcare costs. This means that after spending a certain amount on healthcare using your own money, the plan starts to cover all other related medical expenses covered by the policy.

As mentioned, a zero-premium Medicare Advantage plan usually features out-of-pocket Medicare costs you’ll need to pay, such as deductibles, coinsurance, and/or copayments for healthcare services.

As mentioned, a zero-premium Medicare Advantage plan usually features out-of-pocket Medicare costs you’ll need to pay, such as deductibles, coinsurance, and/or copayments for healthcare services.

Some plans come with provider networks, requiring you to receive care from medical professionals in that network. So, you might be unable to visit your usual doctor for a consultation.

For example, a zero-premium Medicare Advantage plan might have a provider network suiting your healthcare needs.

If you venture outside of this network for healthcare services, you’ll end up paying more out-of-pocket costs associated with your treatments and care.

Zero-premium Medicare Advantage plans feature specific enrollment periods during the year.

Check with your provider for the dates of these enrollment periods. Typically, new members can enroll in a zero-premium Medicare Advantage plan, but you’ll need to pay the monthly Part B premium for Original Medicare.

However, some Medicare Advantage plans charge premiums.

Speak to us, and we’ll guide you through everything you need to know about zero-premium Medicare Advantage plans.

Frequently Asked Questions

How can Medicare Supplement plans cost nothing?

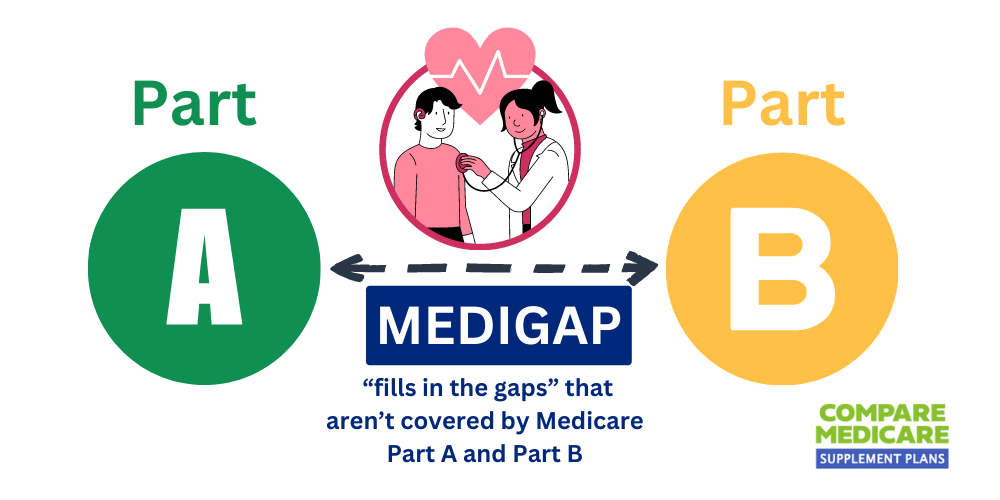

Medicare Supplement plans can cost nothing because they don’t have their own separate premium. To qualify, you need to be enrolled in Medicare Part A and Part B.

Can anyone qualify for Medicare Supplement plans that cost nothing?

To be eligible for zero-premium Medicare Supplement plans, you must already have Medicare Part A and Part B. Availability and costs vary by location and insurance companies.

What are the advantages of Medicare Supplement plans that cost nothing?

Zero-premium Medicare Supplement plans offer additional coverage beyond original Medicare, helping to cover deductibles, copayments, and coinsurance while potentially saving on monthly expenses.

Are there any limitations or restrictions on Medicare Supplement plans that cost nothing?

Zero-premium plans may have higher out-of-pocket costs for medical services and restrictions on coverage. It’s important to review plan details and understand potential expenses.

How do insurance companies offer Medicare Supplement plans that cost nothing?

Insurance companies offering Medicare Supplement plans receive compensation from Medicare. You still need to pay your Medicare Part B premium.

Are there income restrictions for Medicare Supplement plans that cost nothing?

Income restrictions do not apply to Medicare Supplement plans. Eligibility is primarily based on having Medicare Part A and Part B.

Can I switch to a Medicare Supplement plan that costs nothing if I have a different plan?

Yes, you can switch to a zero-premium Medicare Supplement plan, but medical underwriting and potentially higher premiums may apply based on your health condition.

Are prescription drugs covered by Medicare Supplement plans that cost nothing?

No, Medicare Supplement plans don’t cover prescription drugs. You need a standalone Medicare Part D plan or a Medicare Advantage plan for drug coverage.

Can I use a Medicare Supplement plan that costs nothing outside my home state?

Yes, Medicare Supplement plans generally provide nationwide coverage. Confirm with your provider for network availability and coverage details in other states.

Are there alternatives to Medicare Supplement plans that cost nothing?

Yes, alternatives include Medicare Advantage plans, which offer Part A, Part B, and additional benefits. Compare benefits, costs, and coverage limitations to find the best fit.

How Can Medicare Supplement Plans Cost Nothing?

Before you decide, it’s also important to compare quotes from several insurance companies.

To start comparing estimates from the most credible health insurers, submit the form to the right of the screen or call 1-888-891-0229 now!

Updated December 4th, 2022