Medicare Supplement

A Medicare Supplement plan helps offer people on Medicare peace of mind in knowing most, or in some cases all, of their medical bills, will be paid.

What is a Medicare Supplement?

A Medicare Supplement, also known as Medigap, is an insurance policy designed to fill the gaps in Original Medicare (Part A and Part B) coverage.

These plans help manage out-of-pocket expenses such as deductibles, copayments, and coinsurance, providing additional financial protection for Medicare beneficiaries.

Medigap plans are Offered by private insurance companies such as:

Mutual of Omaha

Cigna

Allstate

& Many more.

Medicare Supplement Plans complement the coverage provided by Original Medicare, ensuring comprehensive healthcare coverage.

Medicare Supplement Insurance Plans

There are ten standardized Medicare Supplement Plans available in most states, labeled through N. These plans differ in terms of coverage and cost, allowing individuals to choose a plan that best suits their needs and budget.

Each plan offers a specific set of benefits, and all plans must follow federal and state laws to protect policyholders.

How do Medicare Supplement Plans work with Medicare?

Medicare Supplement Plans work in conjunction with Original Medicare to provide additional coverage for eligible expenses. When you receive medical services, Medicare pays its share of the approved amount, and the Medigap plan pays for the remaining portion, based on the specific plan’s benefits. By doing so, Medigap plans help reduce out-of-pocket costs and provide financial peace of mind.

How do Medicare Supplement Plans work with Medicare?

Medicare Supplement Plans work in conjunction with Original Medicare to provide additional coverage for eligible expenses. When you receive medical services, Medicare pays its share of the approved amount, and the Medigap plan pays for the remaining portion, based on the specific plan’s benefits. By doing so, Medigap plans help reduce out-of-pocket costs and provide financial peace of mind.

What do Medicare Supplement Plans cover?

Although the coverage varies depending on the specific plan, most Medicare Supplement Plans cover the following expenses:

1. Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted

2. Part B coinsurance or copayments

3. Blood (first three pints)

4. Part A hospice care coinsurance or copayments

5. Skilled nursing facility care coinsurance

6. Part A deductible

7. Part B deductible (only available in Plan C and Plan F)

8. Part B excess charges (available in Plan F and Plan G)

9. Foreign travel emergency (up to plan limits)

How much do Medicare Supplement Plans cost?

The cost of Medicare Supplement Plans varies depending on factors such as the specific plan, the insurance company, location, age, and gender. Premiums can be priced using three different methods: community-rated,issue-age-rated, or attained-age-rated. It is essential to compare premium rates across various providers to find the most affordable and suitable plan for your needs.

What are the Best Medicare Supplement Plans?

The best Medicare Supplement Plan depends on individual needs, preferences, and budget. The most popular plans are Plan F, Plan G, and Plan N, each offering varying levels of coverage and cost-sharing:

Medicare Supplement Plan F

Plan F is the most comprehensive Medigap plan, covering all available benefits, including the Part B deductible and excess charges. However, Plan F is no longer available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020.

Medicare Supplement Plan G

Plan G is similar to Plan F, but it does not cover the Part B deductible. This plan offers a balance between comprehensive coverage and cost, making it a popular choice among Medicare beneficiaries.

Medicare Supplement Plan N

Plan N provides a more affordable option for those willing to pay some out-of-pocket expenses in exchange for lower premiums. It does not cover the Part B deductible or excess charges, and it may have copayments for certain office visits and emergency room visits.

When Should you enroll in a Medicare Supplement Plan?

The best time to enroll in a Medicare Supplement Plan is during your six-month Medigap OpenEnrollment Period (OEP), which begins the month you turn 65 and are enrolled in Medicare Part B.During the OEP, insurance companies cannot deny coverage or charge higher premiums due to pre-existing conditions. Enrolling outside of the OEP may result in medical underwriting, potentially affecting your eligibility and premium rates.

How to Apply for a Medicare Supplement

Applying for a medicare supplement Plan involves the following steps:

1. Ensure you are enrolled in both Medicare Part A and Part B.

2. Research and compare Medicare Supplement Plans available in your area, considering coverage, premiums, and insurance providers.

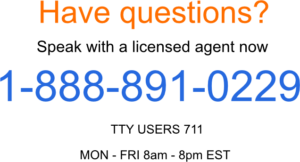

3. Contact the insurance company or a licensed insurance agent to discuss your options and obtain a personalized quote.

4. Complete the application process, providing any necessary documentation.

5. Pay your premium to begin coverage.

Medicare Supplement FAQs

Can I have a Medicare Supplement Plan and a Medicare Advantage Plan at the same time?

No, you cannot have both a Medigap plan and a Medicare Advantage Plan simultaneously. If you decide to enroll in a Medicare Advantage Plan, you must discontinue your MedicareSupplementcoverage.

Can I switch to Medicare Supplement Plans?

Yes, you can switch plans; however, you may be subject to medical underwriting if you are outside of your Medigap Open Enrollment Period, which could impact your eligibility and premium rates.

Are Medicare Supplement Plans standardized?

Yes, all Medicare Supplement Plans are standardized, meaning that each plan of the same letter provides the same benefits regardless of the insurance company offering it. However, premium rates may vary between providers.

Do Medicare Supplement Plans cover prescription drugs?

No, Medicare Supplement Plans do not cover prescription drugs. To receive prescription drug coverage, you must enroll in a separate Medicare Part D plan.

Can I use any doctor or hospital with a Medicare Supplement Plan?

Yes, as long as the provider accepts Medicare patients, you can use any doctor or hospital in the United States.

Do Medicare Supplement Plans cover dental and vision care?

No, Medicare Supplement Plans do not typically cover dental and vision care. You may consider purchasing separate dental and vision insurance plans.

Can my spouse and I share a Medicare Supplement Plan?

No, Medicare Supplement Plans are individual policies. Each person must have their own policy.

Are Medicare Supplement Plan premiums tax-deductible?

In some cases, Medicare Supplement Plan premiums may be tax-deductible as a medical expense. Consult a tax professional for more information.

How do I file a claim with my Medicare Supplement Plan?

In most cases, your healthcare provider will file the claim directly with Medicare, and then Medicare will send the claim to your Medigap insurance company. If necessary, you can also submit a claim to your insurance provider directly.

Are pre-existing conditions covered under Medicare Supplement Plans?

If you enroll during your Medigap Open Enrollment Period, you cannot be denied coverage or charged higher premiums due to pre-existing conditions. If you enroll outside of this period, you may be subject to medical underwriting, which could impact your coverage and rates.

How to Get Started

Understanding Medicare Supplement Plans is crucial for making informed decisions about your healthcare coverage. By considering the various options, costs, and enrollment processes, you can find the best plan to complement your Original Medicare coverage and provide financial protection against out-of-pocket expenses.

Updated December 4th, 2022