Who Does Medicare Supplemental Insurance Cover?

Medicare is a health insurance program that is sponsored by the United States government via the Centers for Medicare and Medicaid Services (CMS). Millions of Americans depend on this program for their medical needs; specifically Original Medicare, or Part A and Part B.

While Original Medicare is certainly a lifesaver, there is a downside – it doesn’t cover all medical expenses, such as copayments, coinsurance, and deductibles. Medicare Supplemental Insurance (also known as Medigap) can help to cover these additional costs.

If you’ve recently enrolled in Original Medicare or you will be enrolling in the future, you’re probably exploring Medigap, and you likely have a lot of questions.

“Who does Medicare Supplemental Insurance cover?” is a question that a lot of Medicare beneficiaries have. In an effort to help you make the most informed decision for your healthcare needs, in this guide, we’ll answer this question and provide additional important information.

Medicare Supplemental Insurance: An Overview

As stated above, Original Medicare consists of two parts:

- Part A, which covers the cost of medical care you receive on an inpatient basis (hospital stays, etc.),

- and Part B, which covers the cost of medical care you receive on an outpatient basis (doctor visits, etc.).

Original Medicare doesn’t cover all of the expenses that are related to inpatient and outpatient care, and you’re responsible for the costs that Part A and Part B leave behind.

Those out-of-pocket expenses can be unpredictable and can become cumbersome – especially if you need a lot of medical care, but Medicare Supplemental Insurance (Medigap) can help.

Medigap is supplemental insurance; in other words, it isn’t a replacement for Original Medicare, but it works alongside it, filling in the “gaps” in Part A and Part B coverage (hence why it’s also called “Medigap”).

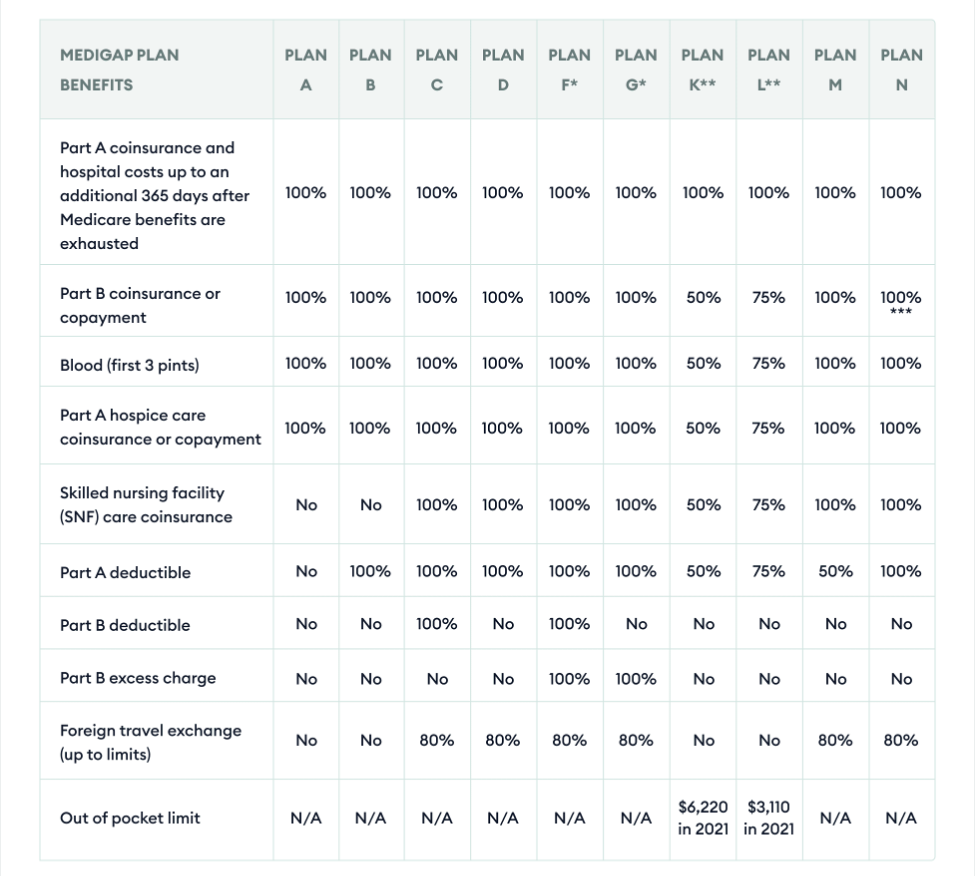

There are 10 Medicare Supplemental Insurance plans, which are sold by private insurance companies and regulated by the federal government.

The plans are named for letters and each lettered plan offers different benefits; however, coverage is standardized, meaning that the same lettered plan is legally required to provide the same coverage, no matter what part of the country it’s purchased in or which health insurance company it’s purchased from.

Compare Plans & Rates

Enter Zip Code

What Does Medicare Supplemental Insurance Cover?

There are 10 Medicap plans, which include A, B, C, D, F, G, K, L, M, and N. Benefits vary from plan to plan.

However, most plans will cover all or a percentage of the following costs that are left behind by Medicare Part A and Part B:

- Part A coinsurance and hospital expenses

- Part A hospice coinsurance and copays

- Part B coinsurance and copays

- First three pints of blood required for medically necessary blood transfusions

Some Medicare Supplemental Plans will include the above, and will also offer the following benefits:

- Part A deductible

- Part B deductible

- Part B excess charges

- Expenses related to skilled nursing facility care

- Medical care provided on an emergency basis while traveling outside of the United States

What Isn’t Covered by Medicare Supplemental Insurance?

While Medicare Supplemental Insurance plans can help to cover some of the out-of-pocket expenses that are associated with Original Medicare, none of the 10 plans will cover the following costs:

- Prescription drugs

- Vision care

- Dental care

- Hearing care

Medicare Part D provides coverage for prescription drugs, which can be added to Original Medicare.

Some health insurance companies that sell Medigap plans provide policyholders with additional perks, which may include coverage for the things that Medicare Supplemental plans don’t cover.

Who Does Medicare Supplemental Insurance Cover?

Now to answer the initial question: Who does Medicare Supplemental Insurance cover?

In short, anyone who is eligible for Original Medicare can purchase one of the 10 supplemental plans.

In short, anyone who is eligible for Original Medicare can purchase one of the 10 supplemental plans.

More specifically, Medigap insurance covers anyone who is eligible for Original Medicare, which includes individuals who are 65 or over, as well as younger individuals who have been diagnosed with qualifying diseases or illnesses.

What are the Eligibility Requirements for Individuals Aged 65 and Older?

While anyone who is 65 years of age or older and is eligible for Medicare Part A and Part B can purchase Medigap insurance, there are some additional eligibility requirements that need to be met:

- You must be enrolled in both parts of Original Medicare (Part A and Part B)

- You must be a US citizen or a legal resident for a minimum of 5 years

- You must live in a state that offers the Medigap plan you would like to purchase at the time you apply (not all states offer the same plans, and things do change periodically)

When Can You Enroll in Medicare Supplemental Insurance?

As long as you meet the eligibility requirements, you can purchase a Medigap plan anytime you’d like; however, the best time to do so is during the Open Enrollment period.

During this period, your application cannot be subjected to medical underwriting.

During this period, your application cannot be subjected to medical underwriting.

In other words, health insurance companies cannot consider your current health or your medical history when evaluating your application, and as such, you are guaranteed acceptance and your premiums will be lower.

If you apply outside of the Open Enrollment period, your application can be subjected to medical underwriting, which means that your premiums could be higher or you could be denied coverage.

The Medigap Open Enrollment period starts on the first day of the month you turn 65 and lasts for 6 months. You must also be enrolled in Medicare Part B.

Frequently Asked Questions

Who does Medicare Supplemental Insurance cover?

Medicare Supplemental Insurance, commonly known as Medigap, covers individuals who are already enrolled in Medicare Part A and Part B. It’s designed to help fill the “gaps” in Original Medicare coverage, such as copayments, deductibles, and coinsurance.

Can Medicare Supplemental Insurance cover prescription drugs?

No, Medigap plans do not cover prescription drugs. For prescription drug coverage, individuals need to enroll in a Medicare Part D plan, which is a separate prescription drug plan available from private insurance companies.

Does Medicare Supplemental Insurance cover pre-existing conditions?

Yes, Medigap plans generally cover pre-existing conditions after a waiting period, which is usually six months from the policy start date. During this period, the plan can’t deny coverage or charge higher premiums due to pre-existing conditions if you have continuous “creditable coverage.”

Is Medicare Supplemental Insurance available for individuals under 65?

In most states, Medigap policies are only available to individuals aged 65 and older, who are already enrolled in both Medicare Part A and Part B. However, there are a few states that offer Medigap plans to individuals under 65 under certain circumstances.

Can I keep my current doctors with Medicare Supplemental Insurance?

Yes, you can generally keep your current doctors with Medigap, as long as they accept Medicare assignment. Medigap plans provide nationwide coverage, so you’re not limited to a specific network of doctors or hospitals.

Does Medicare Supplemental Insurance cover vision and dental expenses?

No, Medigap plans do not cover routine vision and dental expenses. If you need coverage for these services, you may consider purchasing a separate vision or dental insurance plan.

Can I change my Medicare Supplemental Insurance plan?

Yes, you can change your Medigap plan, but there are certain restrictions. Generally, the best time to switch plans is during the six-month Medigap Open Enrollment period that starts when you’re 65 or older and enrolled in Medicare Part B. Outside of this period, you may face medical underwriting.

Is Medigap the same as Medicare Advantage?

No, Medigap and Medicare Advantage are not the same. Medicare Advantage (Part C) is an alternative to Original Medicare and often includes prescription drug coverage and additional benefits. Medigap, on the other hand, works with Original Medicare and helps cover out-of-pocket costs.

Can I have both Medigap and Medicaid?

In most cases, if you have Medicaid, you cannot also have Medigap. However, there are exceptions, and some states offer special Medigap plans for individuals with both Medicare and Medicaid, called Medicare-Medicaid Plans (MMPs).

Do I need to renew my Medicare Supplemental Insurance every year?

No, your Medigap policy is guaranteed renewable as long as you pay your premiums on time. It does not automatically renew each year, but the insurance company must continue to offer you the same benefits in the plan.

How Much Does Medicare Supplemental Insurance Cost?

It’s important to note that since Medigap is supplemental insurance, it does have its own monthly premium, in addition to the monthly premiums for Medicare Part A and Part B.

The cost varies and depends on several factors, such as the plan you purchase, which insurance company you purchase a policy from, your location, and your age – just to name a few.

Since pricing for Medicare Supplemental Insurance does vary, to ensure you get the most affordable rates, comparing quotes from different insurance companies is imperative.

For instant access to quotes from the most reputable insurers in your area, submit the form to the right of your screen or call 1-888-891-0229. Our team of licensed agents is looking forward to helping you find and choose the best plan to meet your unique needs.

Updated December 4th, 2022