Medicare Plan F Vs Plan G – What’s the Difference?

Are you approaching retirement age? If you’re turning 65 soon, you have the option of enrolling in Medicare to support the costs of your medical expenses during your senior years.

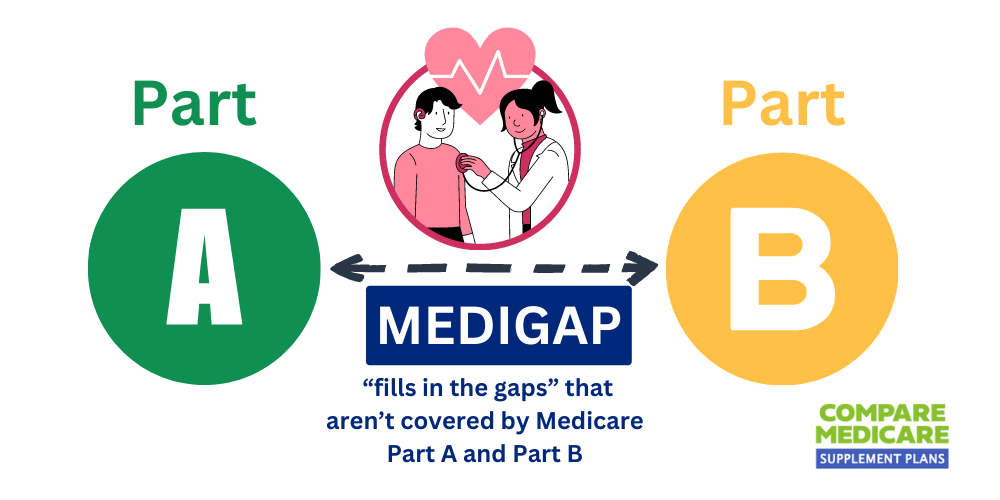

Original Medicare offers plenty of benefits but doesn’t cover everything.

You could incur additional medical expenses you must pay out-of-pocket after a hospital stay. That’s where Supplemental Medicare plans (Medigap) come into play. There are ten Medigap plans, and Plan G & F are among the most popular options.

Plan G & F offers you the most comprehensive level of medical care, covering all your inpatient and most of your outpatient medical expenses that aren’t included in Original Medicare Part A & B.

Speak to the Professionals about Medicare Plan F Vs Plan G

Understanding the differences between Medigap Plans 2024 can be challenging. If you’re having trouble identifying the differences in coverage and premiums between plans and insurers, call us for assistance.

Our experts are available to you at 1-888-891-0229.

Or complete the contact form on our site, and we’ll have a Medigap professional call you for a free consultation on the right plan to suit your requirements.

We aim to give you the information you need to make an informed decision.

Compare Plans & Rates

Enter Zip Code

Understanding Medicare Supplement Plan F

Medigap Plan F was the leading supplemental Medicare plan until the introduction of Plan G.

Plan F was discontinued in January 2020 for new Medicare members becoming eligible for Original Medicare Part A & B after this date.

If you were eligible for Medicare before this date, you could still enroll in Plan F. If you’re still using Plan F, you can continue with it. Plan F is the most comprehensive supplemental Medicare insurance available.

With Plan F, you get coverage for all out-of-pocket inpatient, outpatient, and specialized medical care costs.

The only thing it doesn’t cover is preventative medical costs, such as chiropractor and acupuncture visits and dental, vision, and hearing expenses.

With Plan F, you can visit any medical provider in the Medicare network nationwide.

If the doctor or specialist charges more than the recommended Medicare rate, Plan F picks up the excess charges up to 15% above this standardized rate.

Understanding Medicare Supplement Plan G

Plan G is gaining in popularity thanks to the discontinuation of Plan F. Like Plan F, Plan G offers new Original Medicare members the most comprehensive level of care available.

The primary difference between Plan G & F is that Plan F covers the Part B deductible, while Plan G doesn’t.

You might think that that makes Plan F more financially attractive, but hold on. The Part B deductible for Original Medicare is only $226 in 2023. Sure, that’s a decent amount of money for seniors living on a fixed income during their retirement.

However, Plan G also has a lower monthly premium than Plan F.

For instance, in California, the average cost of a Plan F policy is $249.10 per month, or $2, 989.20 annually. The average price of a Plan G premium in California is $176.40 per month or $2,116.80 annually.

So, using this example, taking a Plan G policy would save you $872.40 on your annual premiums compared to Plan F.

If we deduct the $226 Part B deductible from this amount, you save $646.40 per year with Plan G.

However, while this example shows a clear difference between the financial costs of Plan G & F, it’s not always as black-and-white.

The premium costs for each plan differ depending on the state you live in and the insurance carrier you use for your plan.

For instance, the costs of Medigap Plan G in California are higher than in Atlanta. The cost of taking the plan with a company like Humana will differ from the premium cost offered by Aetna. While the benefits remain standardized, the premiums can vary widely.

Insurers also examine elements like your age, health status, marital status, and smoking status to determine your premium costs.

Some providers also offer discounts and additional benefits over other carriers.

Also, some states may offer a high-deductible version of Plan G.

In contrast, others only provide a standardized Plan G. That’s why you need an experienced and knowledgeable agent to help you identify the best carrier in your state. We can help you find the best premium available.

What are the Differences & Similarities Between Medicare Plan F vs Plan G?

Medigap Plans G & F are remarkably similar. Apart from the Part B deductible and the premium costs, they have a very similar level of coverage for your inpatient, outpatient, and specialized medical expenses.

Both Plan G & F cover the following gaps in Original Medicare Part A & B.

- Part A deductible.

- Part A coinsurance.

- Part B coinsurance or copayment.

- The first three pints of blood in transfusions.

- Skilled nursing facility coinsurance or copayment costs.

- Hospice care coinsurance or copayment costs.

- 80% of foreign emergency medical care is not covered by Original Medicare.

Frequently Asked Questions

Is Medicare Plan F better than Plan G?

No. The only additional benefit you get from Plan F over Plan G is that Plan F covers the Part B deductible in Original Medicare. Currently, the Part B deductible for 2023 is $226. So, you could easily save that and more by switching to Plan G while retaining all the same benefits as Plan F.

Can I switch from Plan F to Plan G? Is it worth it?

Yes. If you currently have Plan F, you can switch to Plan G. Our team can assist you with making the transition, ensuring everything goes smoothly. Changing to Plan G can save you up to +$600 on your annual premium costs, depending on where you reside in the United States and which insurance carrier you choose for your policy.

Why was Plan F discontinued for new Medicare members?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) prevents private insurers from offering people who join Medicare after January 2020 access to Plan F. The Act aims to get Medicare members to choose more economical treatment options, such as Plan G.

Medicare Plan F Vs Plan G – How to Get Started

The easiest way to get started is to call us today at 1-888-891-0229.

We’ll answer all of your questions and help you. Or you can use our FREE quote engine to begin shopping today!

Updated December 4th, 2022