A Quick Guide to Humana Medigap Plan N

Why pay out-of-pocket expenses with Medicare when you can take care of them with a supplemental “Medigap” plan?

Humana Medigap Plan N offers a way to mitigate these costs, giving you more predictability in your annual healthcare expenses and more confidence, knowing you have some of the best coverage available to offset medical costs.

You’re eligible for a Medigap plan if you have Original Medicare Parts A & B.

Medigap has eight different options (10 if you include Plan C & F). With Medigap, you get a “gap cover” paying for many of the inpatient and outpatient medical expenses not covered by Original Medicare Parts A & B.

With Medigap, you won’t be left holding the bag after visiting the doctor or a hospital stay.

Several private insurers across America offer access to Medigap Plan N. This post covers the benefits of Humana Medigap Plan N and how it works.

Call Us Today for Professional Advice on Humana Medigap Plan N

We’re a leading brokerage helping you find the right Medigap provider anywhere in the United States.

You can rely on our team of experts to source the best Medigap provider in your state, securing you the lowest premium possible for Medigap Plan N.

Call us at 1-888-891-0229 or complete the contact form on this site. We’ll put you in touch with a broker for a free consultation.

Let us help you find the right plan N insurer and the best premiums rate in your state.

Compare Plans & Rates

Enter Zip Code

Who Is Humana?

Based in Louisville, Kentucky, Humana is one of the largest healthcare insurers in the United States.

Humana offers a range of Medigap and Medicare Advantage Plans to cover all your healthcare requirements.

Humana serves nearly 9 million Americans with Medicare and Medigap policies, with the company posting a 2022 annual revenue of $92.9 billion.

Humana caters to approximately 333,000 Medigap clients, giving it a 2.1% market share in the industry.

Humana covers 49 US states with Medicare Supplement Insurance, operating in Washington, D.C., and Puerto Rico. However, Humana doesn’t offer services in Virginia.

Humana Medigap Plan N At a Glance

Humana offers all Medigap Plans for 2024, including Plan N. The company has plenty of extra benefits for its members.

However, it’s one of the more expensive insurers in most states, especially in some less popular plans.

According to research, Humana Medigap policy premiums are approximately 70% higher than the lowest competition in most states.

The company receives triple the number of complaints than any other insurer in the Medigap industry, most of which relate to high premium costs compared to competitors.

While Humana policies are usually more expensive than other insurers, the benefits offered when taking Plan N, such as loyalty discounts, meal delivery, and access to the “SilverSneakers” program, make it worthwhile investigating and comparing to other quotes from insurers in your area.

Humana Medigap Plan N – Benefits and Coverage

Medigap Plan N is one of the most popular Medigap policies.

It offers beneficiaries a good level of coverage close to being comprehensive. Comparatively, only Plan G provides you with a better level of coverage.

(Plan F & C are also more comprehensive. However, they’re no longer available for people eligible for Medicare after January 1, 2020).

If you’re a senior or retiree that doesn’t incur many medical costs during the year but wants the best medical care if things go wrong, Plan N is a good option.

Since Plan N isn’t as comprehensive as G, F, or C, it comes with lower premiums, reducing the monthly cost of your healthcare.

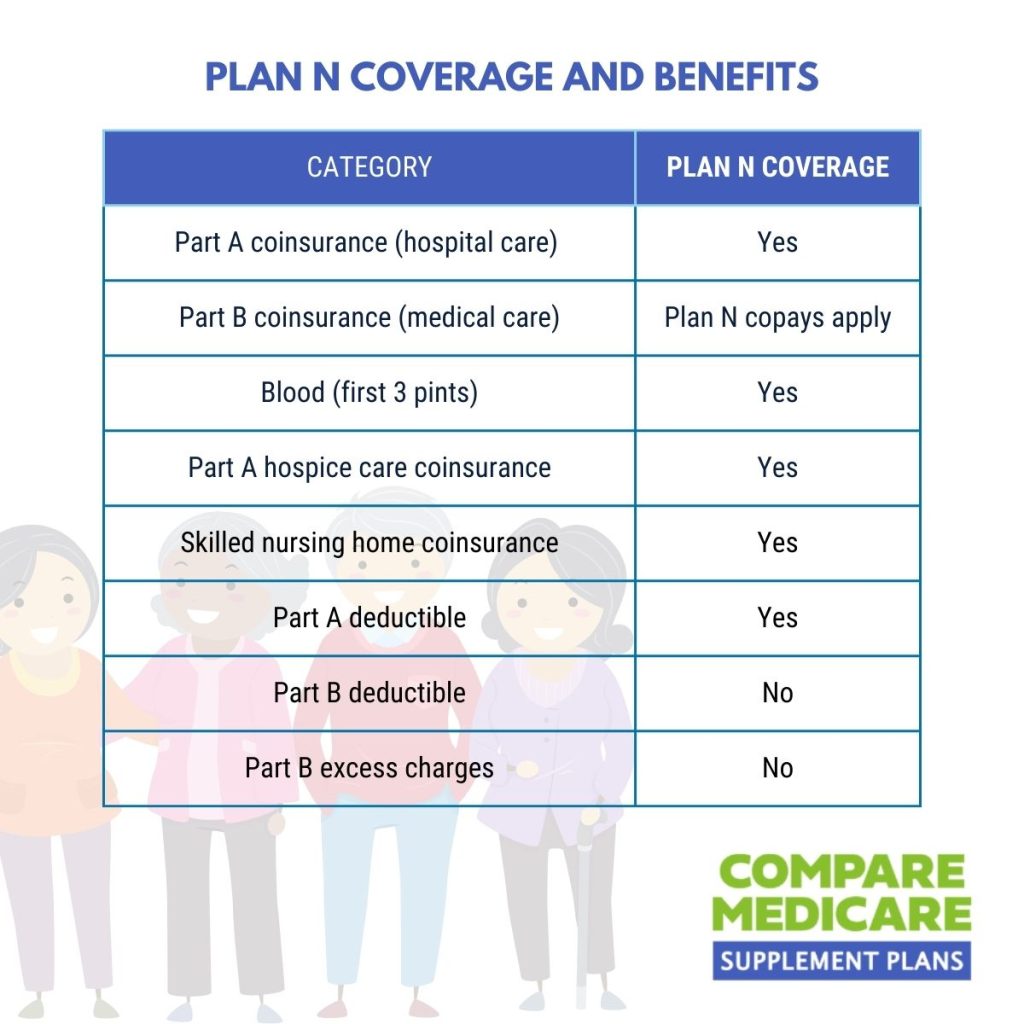

Medigap Plan N offers you the following coverage:

- Medicare Part A hospital costs and coinsurance, including hospice care.

- Medicare Part A Deductible of $1,600 for 2023.

- Medicare Part B copayments and coinsurance for outpatient services and doctor visits.

- The first three prints of blood in transfusions which Original Medicare doesn’t cover.

- Coinsurance for stays at skilled nursing facilities.

- 80% of the medical costs incurred by emergency care services while traveling abroad.

Plan N doesn’t cover the following medical expenses:

- Part B excess fees – Plan N doesn’t cover you for the additional cost of consultations charged by doctors working outside of Medicare rates.

- Medicare Part B deductible – Plan N doesn’t cover the $226 Part B deductible.

With Medigap Plan N, you can visit any medical professional operating within the Medicare network nationwide.

However, you’ll need to make a 20% copayment for visits to the doctor’s office or a specialist until you meet the deductible limit of $1,600 for Part A.

You’re also responsible for a $50 copayment when visiting the emergency room, but only if you aren’t admitted to the hospital.

You can circumvent the excess charges by visiting doctors that charge Medicare rates (Medicare assignment).

Humana Plan N Additional Benefits

There are several additional benefits offered to qualifying Humana clients when taking Medigap Plan N.

Some of the other benefits include access to the SilverSneakers fitness program, allowing you to save on your gym membership costs if you’re an active senior.

Humana offers a meal delivery program, delivering pre-cooked healthy meals to your home after arriving home from a stay at the hospital or a nursing facility.

Humana also offers qualifying members discounts on prescriptions, hearing and vision services, and access to its Lifeline medical alert service and a nurse line service to handle health-related questions.

Humana Medigap Plan N – Monthly Premiums

Humana is one of the most expensive insurers for Medigap Plan N in most states. On average, their Plan N premiums are around 58% higher than the least expensive option in the region.

We examined the policy rates for a 65-year-old female nonsmoker in three cities. In Atlanta, Humana meets the average cost for a Plan N policy from all insurers.

They’re more expensive than average in Los Angeles, and lower than the average for members in Washington, D.C:

- Los Angeles average Plan N premium cost: $174.29.

- Atlanta average Plan N premium cost: $113.

Humana offers premium discounts of 6% for applying for a Medigap policy online.

There’s also a household discount if more than one person in your household signs up for a Humana Medigap policy.

Qualifying members receive a $2 monthly saving on their premium if they set up an automatic recurring payment using their bank account or credit card.

Humana Medigap Plan N – Customer and Industry Reviews

Unfortunately, Humana receives 251% more customer complaints than the industry average. Most of them relate to the higher premiums they charge compared to competitors.

However, Humana has an AM Best Financial Strength Rating of A-, meaning it spends most of its premiums on member benefits.

Frequently Asked Questions

What is Humana Medigap Plan N?

Humana Medigap Plan N is a Medicare Supplement insurance plan offered by Humana. It helps cover certain out-of-pocket costs not covered by Original Medicare, such as deductibles, coinsurance, and copayments.

How does Humana Medigap Plan N differ from other Medigap plans?

Humana Medigap Plan N provides similar coverage to other Medigap plans but with some cost-sharing features. Plan N requires you to pay a small copayment for certain doctor visits and emergency room visits. Additionally, it does not cover the Medicare Part B deductible.

What benefits does Humana Medigap Plan N provide?

Humana Medigap Plan N covers Medicare Part A coinsurance and hospital costs, Medicare Part B coinsurance or copayment, blood transfusions, Part A hospice care coinsurance or copayment, and skilled nursing facility coinsurance. It also includes coverage for emergency care during foreign travel.

How much does Humana Medigap Plan N cost?

The cost of Humana Medigap Plan N can vary depending on factors such as your location, age, and gender. It’s best to contact Humana or use their online tools to get a personalized quote.

Can I see any doctor or specialist with Humana Medigap Plan N?

Yes, with Humana Medigap Plan N, you have the freedom to choose any doctor or specialist who accepts Medicare patients.

Does Humana Medigap Plan N include prescription drug coverage?

No, Humana Medigap Plan N does not include prescription drug coverage. To get prescription drug coverage, you can enroll in a separate Medicare Part D plan offered by private insurance companies.

Are there any network restrictions with Humana Medigap Plan N?

No, Humana Medigap Plan N does not have any network restrictions. As long as the doctor or hospital accepts Medicare, you can use your plan benefits.

Can I switch to Humana Medigap Plan N from another Medigap plan?

Yes, in most cases, you can switch to Humana Medigap Plan N from another Medigap plan. However, it’s important to review the terms and conditions of your existing plan and consult with Humana for a seamless transition.

Does Humana Medigap Plan N cover dental or vision services?

No, Humana Medigap Plan N does not cover routine dental or vision services. You may consider purchasing a separate dental or vision insurance plan to meet those needs.

Is Humana Medigap Plan N available in my state?

Humana Medigap Plan N is available in many states across the United States. You can check with Humana or use their online tools to see if it is offered in your state.

Humana Medigap Plan N - How to Start

Before you decide on a Medigap policy, it’s also essential to compare quotes from several insurance companies.

To start comparing estimates from the most credible health insurers, submit the form to the right of the screen or call 1-888-891-0229 now!

Updated December 4th, 2022