Lumico Medicare Supplement Reviews

If you’re a member of Original Medicare, you might find it surprising that you don’t have full coverage of your healthcare expenses. Medicare only covers you for 80% of Parts A & B costs. You have to pay the balance of your expenses, leaving you out of pocket.

Lumico Medicare Supplement Plans offer a way to cope with these expenses. As one of the leading healthcare insurers in the United States, Lumico gives you a range of Medigap plans to assist you with covering the costs of inpatient and outpatient care associated with Original Medicare.

Lumico’s Medigap Plans have different levels of coverage, and they come at various price points. This post gives you everything you need to know about Lumico Medicare Supplement Plans. We’ll discuss the policies they have available, the benefits and coverage they offer, and what you can expect to pay for each plan.

Lumico Medicare Supplement Plans at a Glance

Lumico Medicare Supplement plans bring you competitive rates compared to other carriers operating in its service area. It has a limited number of plans in its offering, focusing on the most popular versions with the best benefits (except for Plan A, which all insurers must offer).

Lumico also has some of the lowest annual increases in premium rates and offers guaranteed renewable Medigap plans. You get your policy issued in less than 24 hours and immediate access to benefits when signing up in the open enrollment period.

The company has a competitive household discount and processes most claims in four days. Policyholders also have access to a digital platform for processing and following up on their claims submissions.

Who Is Lumico?

Previously known as “Generation Life Insurance Company,’ Lumico Life Insurance Company is one of the leading providers of Medigap supplement policies in the United States. Founded in 1965, iptiQ Americas Inc. acquired Lumico in 2016, a member of the Fortune 500 reinsurance company, “Swiss Re.”

Previously known as “Generation Life Insurance Company,’ Lumico Life Insurance Company is one of the leading providers of Medigap supplement policies in the United States. Founded in 1965, iptiQ Americas Inc. acquired Lumico in 2016, a member of the Fortune 500 reinsurance company, “Swiss Re.”

Elips Life Insurance Co. underwrites all Medigap policies issued by Lumico and manages over $60 million in assets. Lumico has a broad service area, providing Medigap policies in 35 states. However, its Plans are unavailable to residents of Washington D.C and Puerto Rico.

Lumico Medicare Supplement Plans – Benefits & Coverage

Lumico offers five types of Medigap plans, focusing on the most popular policies in the Medigap range. The company offers Plan A, F, G, High-deductible Plan G, and Plan N. All insurers must offer Plan A as per Federal guidelines. You’ll need to be a beneficiary of Original Medicare Parts A & B to get a Medigap plan from Lumico.

Here’s a quick breakdown of each plan offered in the Lumico range.

- Plan A – The basic benefits package, ideal for low-income seniors who want to bolster their Original Medicare policies.

- Plan F – The most comprehensive Medigap policy and the only plan offering coverage for the Part B deductible. However, Plan F is no longer available to new Medicare beneficiaries qualifying for Parts A & B after January 1, 2020. If you are eligible before this cut-off date, you can still buy a Plan F policy.

- Plan G – The most comprehensive Medigap Plan after Plan F. The only thing Plan G doesn’t cover that Plan F does is the Part B deductible.

- High Deductible Plan G – Lumico offers a high-deductible Plan G in some states. The HD version dramatically lowers your monthly premium responsibilities, but your annual Part A deductible increases from $1,600 to $2,700.

- Plan N – is attractive to seniors who don’t incur many healthcare expenses during the year but want the best coverage in a medical emergency. You get low monthly premiums, but you’ll make copays at the emergency room and doctor’s office.

All Medigap plans offer policyholders the following benefits and coverage for their Original Medicare Parts A & B.

- Part A coinsurance and hospital costs up to 365 days after Medicare benefits expire.

- Part A hospice care coinsurance or copayment.

- Part B copayments and coinsurance.

- Blood transfusion (for the first three pints).

Plans F, G, and N offer policyholders the following additional benefits for Medicare Parts A & B.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover excess charges for doctors’ consultations, with practitioners charging above the “Medicare Assignment” rate. You can mitigate excess charges by visiting doctors charging Medicare-approved rates).

- Coinsurance for care at a skilled nursing facility.

- 80 % of medical costs for medical emergencies incurred during the first 60 days of traveling outside the US (a $250 deductible applies, and you have a $50,000 maximum lifetime coverage limit).

What Lumico Medicare Supplement Plans Don’t Cover

Lumico Medigap policies don’t cover the Part B deductible (only Plan F offers this). Plan N policies require copayments of $20 at the doctor’s office and $50 at the emergency room if you’re not admitted.

All Medigap policies don’t cover prescriptions, or preventative healthcare services like private nursing care, hearing, vision, and dental benefits, physiotherapy, and long-term care at non-skilled nursing homes.

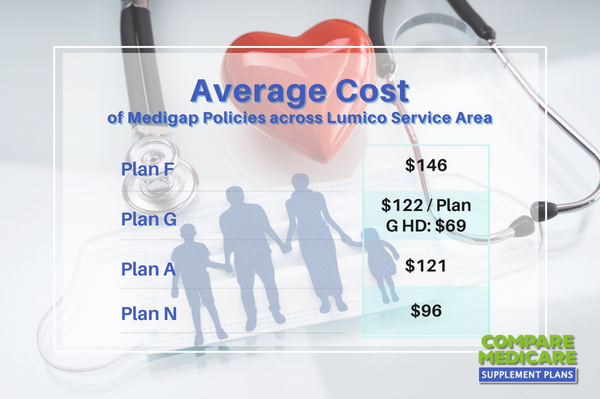

Lumico Medicare Supplement Plans – Premiums

Premiums for Medigap plans vary depending on your age, gender, smoking status, and location in the United States. Here is the average cost of Medigap policies across the entire Lumico service area.

Lumico also offers one of the best household discounts in the market. Your spouse, life partner, or adult living in your home can qualify for up to a 12% household discount when taking a Medigap policy.

Lumico Medicare Supplement Plans – Third-Party Ratings & Reviews

Lumico has a reputation for great customer service. It gets an “A” (Excellent) rating from AM Best for its financial strength and a “B” rating from the Better Business Bureau.

Frequently Asked Questions

Who is eligible for Lumico Medicare Supplement Plans?

Lumico Medicare Supplement Plans are available to individuals who are already enrolled in Medicare Part A and Part B. Eligibility requirements include being 65 years or older or having certain disabilities.

When can I enroll in Lumico Medicare Supplement Plans?

The best time to enroll in Lumico Medicare Supplement Plans is during your Medigap Open Enrollment Period, which starts when you are 65 years old and enrolled in Medicare Part B. This period lasts for six months and guarantees you access to any plan without medical underwriting.

What are the best Medicare Supplement Plans offered by Lumico?

Lumico offers a range of Medicare Supplement Plans, including Plan A, Plan F, Plan G, and Plan N. The best plan for you depends on your specific healthcare needs and budget. Plan G and Plan N are popular options as they provide comprehensive coverage at more affordable premiums than Plan F.

What is the difference between Medicare Plan G and Medicare Plan N?

The main difference between Medicare Plan G and Plan N is that Plan N requires you to pay certain copayments or coinsurance for doctor visits, emergency room visits, and some hospital stays. Plan G, on the other hand, covers these costs completely. Both plans offer extensive coverage and are highly regarded by Medicare beneficiaries.

What does coverage with Lumico Medicare Supplement Plans include?

Lumico Medicare Supplement Plans provide coverage for various healthcare costs not covered by Original Medicare, such as deductibles, copayments, and coinsurance. The specific coverage depends on the plan you choose but generally includes hospital stays, medical procedures, skilled nursing facility care, and other eligible expenses.

What benefits do Lumico Medicare Supplement Plans offer?

Lumico Medicare Supplement Plans offer benefits such as coverage for Medicare Part A and Part B coinsurance, coverage for additional hospitalization days, coverage for skilled nursing facility care, and coverage for emergency medical services received outside the United States (up to plan limits).

How are premiums determined for Lumico Medicare Supplement Plans?

Premiums for Lumico Medicare Supplement Plans are influenced by various factors, including your location, age, gender, and tobacco use. It is recommended to compare quotes from Lumico and other insurance providers to find competitive premiums for the desired coverage.

Can I switch from a different Medicare Supplement Plan to a Lumico plan?

Yes, you can switch from one Medicare Supplement Plan such as Aetna, or Anthem, to another, including switching to a Lumico plan. However, eligibility and underwriting rules may apply depending on the timing and circumstances of the switch.

Are prescription drugs covered under Lumico Medicare Supplement Plans?

No, Lumico Medicare Supplement Plans do not include prescription drug coverage. To get prescription drug coverage, you can enroll in a standalone Medicare Part D prescription drug plan.

Where can I find reviews and more information about Lumico Medicare Supplement Plans?

To find reviews and gather more information about Lumico Medicare Supplement Plans, you can visit Lumico’s official website, read customer testimonials, and consult independent review websites that evaluate insurance providers. Additionally, speaking with a licensed insurance agent can provide personalized guidance.

Get Free Advice and Quotes on Lumico Medicare Supplement Plans

With so many Medigap policies and providers available, settling on the right provider and plan is challenging. You can rely on our Medigap experts for accurate advice on any Lumico Medicare Supplement Plan.

Contact us at 1-888-891-0229 for a free consultation and quote. We’ll walk you through everything you need to know about Medigap.

We aim to give you the information you need to make an informed decision on the right policy and provider for your unique healthcare needs. You can use our online calculator to get a free automated quote on Lumico Medigap plans or leave us your details, and we’ll have an expert call you back.

Updated June 6th, 2023